Economic Update

Overview

The banking crisis that rapidly unfolded in midMarch dramatically affected the economic and financial landscape. The collapse of Silicon Valley Bank (SVB) and Signature Bank, followed by stress at Credit Suisse GroupAG andFirst Republic Bank sharply increased market volatility.

While FDIC and Fed actions to both protect uninsured depositors and provide additional liquidity for banks helped to avert a larger financial crisis, the impact on the economy is likely to be ongoing. We expect banks to tighten lending standards and potentially charge higher rates in order to keep more cash on hand. New regulatory pressures may further contribute to this tightening which is expected to slow GDP growth in the coming quarters.

The Fed expects that U.S. real GDP will contract by at least 1.0% later this year and/or in early 2024. Businesses are expected to hold back fixed investment spending in coming quarters and will likely start downgrading hiring plans. A negative cycle could take hold in which tighter financial conditions lead to slower growth, further financial belt tightening, then even slower growth, and so on. Banking-sector turmoil has thus raised the odds that the U.S. economy, already widely seen as prone to recession, might tip into one.

*Notes: The current GDP estimate is the April 10th GDPNowfigure from the Atlanta branch of the Fed. Other 3/31/23 data is from the latest available release, which may be from the prior month. Fed Funds rate is the lower end of target range.

CCM Key Economic Indicators

Indicator

3.31.23*

12.31.22

3.31.22

U.S. Economy

Quarterly GDP Growth

Est. 2.2%

2.6%

-1.6%

Unemployment Rate

3.6%

3.5%

3.6%

U.S. CPI (Core)

5.6%

5.7%

6.5%

Interest Rates

Fed Funds Rate

4.75%

4.25%

0.25%

10-Year Treasury Rate

3.66%

3.62%

2.13%

Currency & Commodities

Crude Oil (WTI)

$75.68

$80.16

$100.53

Gold Price

$1,979

$1,812

$1,924

Trade Weighted Dollar Index

120.8

122.2

116.4

Confidence

Consumer Confidence Index

104.2

109.0

107.6

ISM Purchasing Managers Index

46.3

48.4

57.0

Stock Prices

Dow Jones Industrial Average

33,274

33,147

34,678

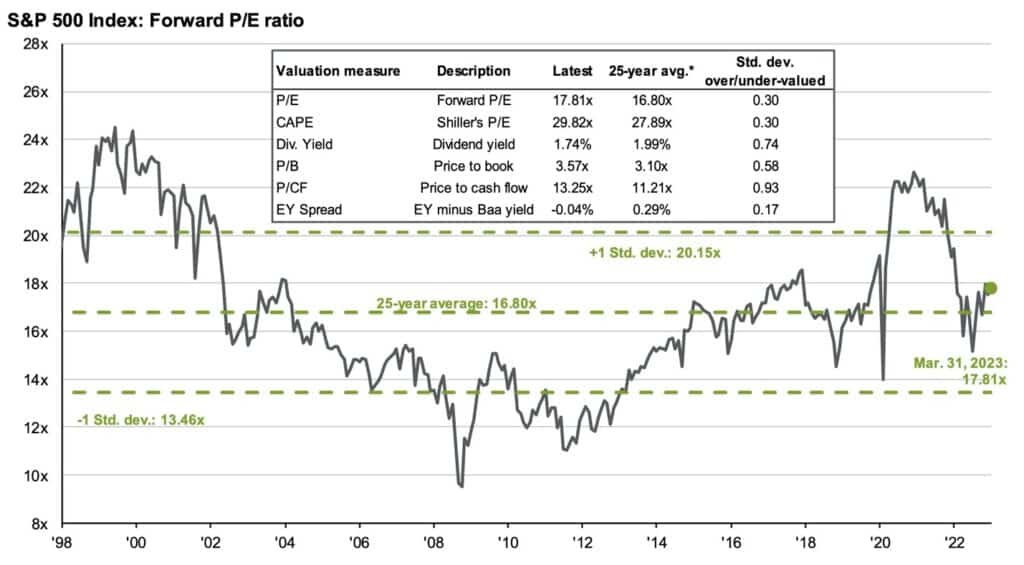

S&P 500 Forward P/E ratio

17.8

16.7

19.5

Labor Market

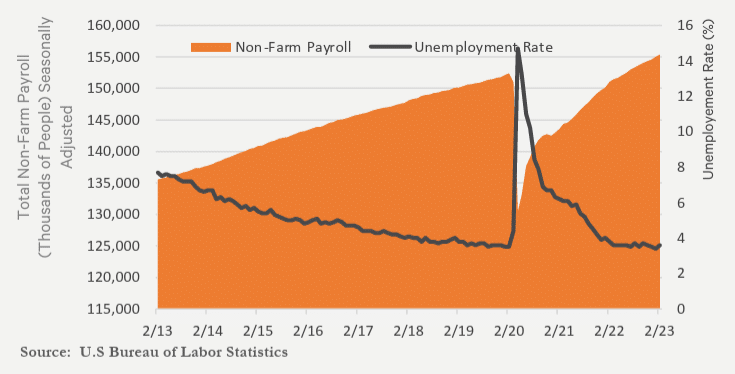

Despite concerns about economic growth, the labor market has remained remarkably strong. Employers added 311,000 jobs in February. The unemployment rate, at 3.6%, remains near a 50-year low, and labor force participation is the highest it has been since the beginning of the pandemic. Non-farm payrolls (the number of people employed) is now well above pre-pandemic levels. However, Fed projections call for unemployment to rise to 4.6% by year end, which would represent the loss of well over one million jobs.

Total Non-Farm Payrolls and Unemployment Rate

Interest Rates and Inflation

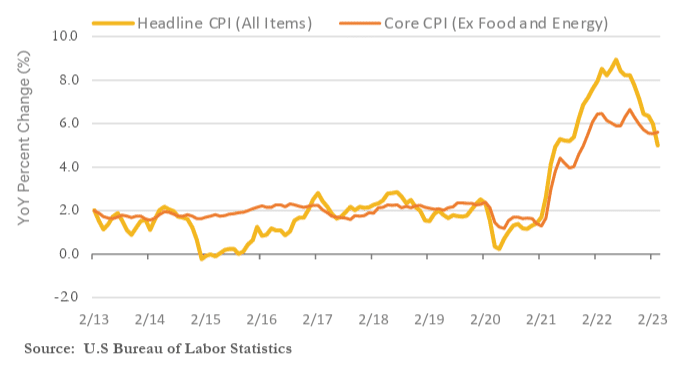

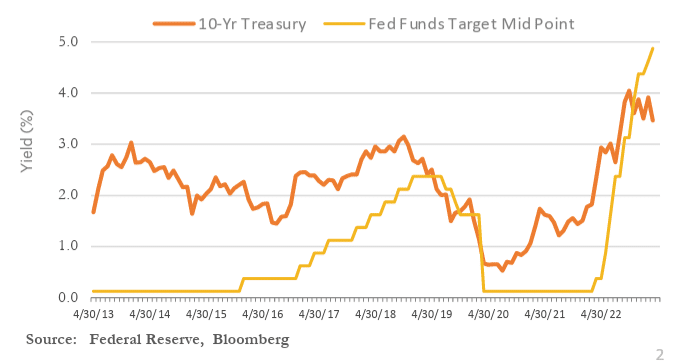

To combat decades-high inflation, the Fed has raised rates at the fastest pace since the 1980s. It raised rates seven times last year (totaling 4.25%) and two more times during the first quarter (totaling 0.5% more). The Fed funds rate is now at its highest level since 2007. The impact of these rate hikes has been substantial. Year-over-year inflation rates have fallen sharply and steadily since the middle of last year. After peaking in June at 8.9%, headline inflation dropped to 6% in February and 5% in March, a dramatic decline but still well above the Fed’s 2% target. Core inflation (excluding food and energy prices) fell to 5.5% in February before rising to 5.6% in March. The monthly increase in headline inflation in March was only 0.1%.

While underlying strength in the labor market suggests the Fed has room to raise rates even further, the recent banking crisis may slow the economy enough that the Fed can stop raising rates.

Despite short-term rates continuing to rise, long-term rates have declined sharply. The rate on the 10-Year Treasury Bonds has declined ¾ of 1% since peaking in November. The drop in longer-term rates suggests that the market increasingly expects short-term rates to be lower in the future than they are today—an outlook that is consistent with growing recession concerns.

Inflation (Consumer Price Index)

10-Yr U.S. Treasury Yield vs. Federal Funds Target Rate

Recession Risk

Questions hung over the economic outlook before SVB failed. Large tech companies had been cutting jobs after overexpanding during the Covid health crisis. Fed interestrate increases had frozen the real-estate sector and rattled stock investors. Corporate profits were declining in many sectors, and consumer moods had soured during two years of a rising cost of living. Yet a strong job market trumped those challenges and kept the economy growing.

The recent banking crisis has increased the risk of recession. When banks lose depositor funds and other sources of money, they pull back on lending, potentially leading to a credit crunch that slows household and business borrowing, spending, and investing.

With these added economic pressures, we believe that a recession in the second half of this year is the most likely scenario. However, much depends on the Fed. Given the continued strength of the labor market, If the Fed stops raising rates, the economy may experience only a mild contraction, or avoid a recession altogether.

Consumer Confidence and Spending

After experiencing elevated inflation and higher interest rates, American consumers are faced with another test. Unrest in the banking sector could make it increasingly difficult for some consumers to obtain loans for buying bigticket items. This is important because consumer spending makes up about 70% of U.S. GDP. Strong consumer spending helped drive the economy out of the pandemic recession, but it has recently shown signs of slowing. A sharp drop in consumer confidence during the quarter further highlights this concern.

Housing Market

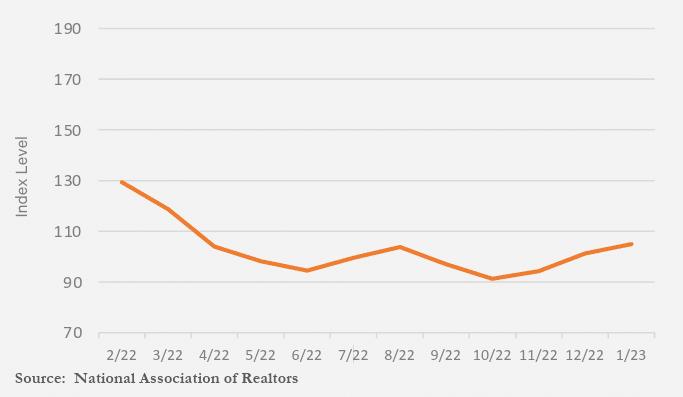

The residential sector ended 2022 with signs that the worst of the housing correction may be in the rear-view mirror as housing affordability improved significantly since October. Buyers are slowly returning as mortgage rates have declined and home prices have softened. Buyers have also been helped by strong labor market conditions that have continued to propel income growth, while easing inflation has enhanced household purchasing power. What is uncertain is whether lower mortgage rates will spur a revival in housing activity or if a looming economic downturn will result in further retrenchment.

Housing Affordability Index

Business Confidence

The American manufacturing sector has shown signs of weakness after two years of solid growth, as higher interest rates and a slowdown in exports have threatened production. Several indicators show that U.S. manufacturing industries have experienced a downturn. These include recent declines in manufacturing production and weak readings in survey-level data. For example, the Institute for Supply Management (ISM) Purchasing Manager’s Index is now at 46.3 vs. 57 a year ago. Readings below 50 indicate a contraction. Manufacturing job growth –a lagging but important indicator –has also lost considerable steam in recent months.

A manufacturing downturn could signal trouble in the broader U.S. economy. Although manufacturing accounts for a relatively small share of gross domestic product, about 11%, it has historically been an early indicator of recession. Weaker manufacturing data has suggested that consumers and businesses are starting to retrench in the face of economic uncertainty.

The U.S. Dollar & The Global Economy

The dollar declined in value during the quarter, and we expect more declines ahead. Rising interest rates abroad, and future Fed rate cuts in the U.S. (particularly if we have a recession) should decrease the relative attractiveness of the dollar vs. foreign currencies.

The outlook for global activity has continued to rise, and global GDP should grow 2.0% to 3% this year, which is well above what is expected in the U.S. The economies of the Eurozone and the United Kingdom have shown more resilience than anticipated. Eurozone GDP should edge up 0.1%, while the current forecast for a 0.6% contraction in U.K. GDP this year is smaller than previously expected.

With underlying inflation pressures proving quite persistent, several central banks are expected to tighten monetary policy more than anticipated. Among the central banks where more rate hikes are expected include the European Central Bank and the Bank of England.

China’s revival has helped boost factory production in other parts of Asia. Ditching strict pandemic curbs in China will boost consumer expenditures. This should boost economic growth in China but should also potentially be a boon for countries like Thailand that are popular among Chinese tourists.

Economic Outlook

The economy needs to weaken more to end inflation quickly. While the manufacturing sector is weakening, the services sector is currently strong. The solid jobs market is keeping consumers feeling upbeat about current conditions. However, the drop in consumer confidence has signaled some caution ahead. Sticky inflation and climbing interest rates, together with the banking crisis, have contributed to this loss of confidence. Mortgage rates are expected to trend lower later in the year as the end of Fed tightening comes closer, which, along with some further easing in home prices, should help improve affordability.

Market Outlook

First Quarter Recap

With the banking crisis, two interest rate increases by the Fed, weakening corporate profits, and rising recession concerns, the first quarter was anything but uneventful. But bad economic news generally translated to good news for the markets. Investors viewed a slowing economy as an indicator that the Fed may be ready to stop raising interest rates. Both stocks and bonds had a nice rebound in the first quarter after their dismal performance in 2022.

During the first three months of the year (Q1), the largecap S&P 500 index posted a 7.5% return, the Russell Midcap was up 4.0%, and the small-cap Russell 2000 gained 2.7%.

Reversing last year’s pattern, Growth stocks far outpaced Value stocks during the quarter. The promise of lower future interest rates aided growth-oriented companies while a sell-off in the banking sector hurt value investors.

International equities also posted positive returns in Q1. The MSCI All Country World Index ex-U.S. was up 7.0%, the MSCI European, Australian, and Far East Index was up 8.7%, and the MSCI Emerging Markets Index was up 4.0%.

The bond market also had a turnaround in Q1 after providing an uncharacteristic sea of red ink in 2022 due to rapidly rising interest rates across the maturity spectrum. The bond market, sensing the end of the rate hiking cycle and anticipating a future recession, had a significant rally. In Q1, the broad US bond market was up 3.0%, high-yield bonds gained 3.6%, and foreign bonds rose 3.1%.

Looking Ahead

The outlook for stocks remains uncertain given the present concerns about the fragility of regional and smaller banks and the beginning of what appears to be a trend of declining corporate earnings performance. In addition, the U.S. stock valuations remain somewhat elevated from historical standards. Much of this is being driven by a relatively small handful of well-known mega-cap Growth stocks which represent a surprisingly disproportionate share of the overall capitalization of the broad stock market. These same growth stocks took a beating last year and may well end up underperforming again in the nottoo-distant future, as value stocks tend to outperform coming out of recessions.

While we believe stocks should provide attractive returns over the long-run, we also expect to see heightened volatility in the near term due to the risks of a slowing economy.

Slower economic growth together withhigher interest rates and more shopping/working being done remotely are all expected to create headwinds for the commercial real estatemarket. Property valuations may decline, although rental rates should adjust upwards with inflation.

In contrast, the outlook for bonds has brightened. This is largely due to: 1) the likelihood that the Fed is close to the end of its rate hiking cycle, 2) inflation is coming down, and 3) bonds now offer respectable coupon rates after years of ultra-low yields.

In contrast, the outlook for bonds has brightened. This is largely due to: 1) the likelihood that the Fed is close to the end of its rate hiking cycle, 2) inflation is coming down, and 3) bonds now offer respectable coupon rates after years of ultra-low yields.

A longer-term view of markets suggests the tailwinds stock and bond investors enjoyed for the past decade or more including massive fiscal stimulus as well as declining and ultra-low interest rates will not resurface any time soon. Securities’ values are more likely to be driven by the organic operational successes of businesses and not help from the federal government. That may result in lower average equity returns in the U.S. than we have experienced over the past few decades. With international stocks priced attractively relative to the US market and with our domestic economy slowing and the expected accompanying depreciation of the dollar, we may see significantly higher returns from international equity investments.

Sources: Capital Market Consultants, Bloomberg, Department of Labor, Department of Commerce, Morningstar, CNN, World Bank, International Monetary Fund, JP Morgan, Blackstone, National Association of Realtors.