ImpactInvesting

Today, the time-honored tradition of thoughtful investing for the greater good goes by many names — ESG, socially responsible, triple bottom line, mission-related and impact investing.

Take this quiz if you want to better align your investments with your values.

Investor interest in this field is growing exponentially, with many new and exciting financial vehicles regularly coming to market.

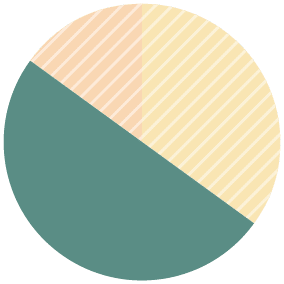

We group these impact investments into three broad categories:

Public and Private Debt

Loans with Purpose

Impact investors can earn modest to competitive returns loaning their capital to a wide range of potential borrowers. Some examples include:

1) buying tax-exempt bonds that support affordable housing, health care and education facilities;

2) making credit-enhanced (low-risk) loans to nonprofit organizations involved in everything from empowering young women to bringing renewable energy, sustainable farming and clean water to rural areas; and

3) funding microfinance operations that provide bottom-of-the-pyramid individuals with the capital to start a business and escape the cycle of poverty.

Public Equities

Selective & Engaged Stock Ownership

Our powerful portfolio management tools allow investors to exclude companies they wish to avoid, and emphasize those with the best environmental, social and governance (ESG) practices. This encompasses considerations such as carbon footprint and environmental responsibility, gender equity and fair pay, leadership diversity and community relations. We also seek out fund managers that take an active role in initiating proxy campaigns and rallying shareholders to refocus corporate management on important sustainability and stakeholder considerations.

Private Equities and Real Assets

Social Enterprise

Providing new capital to carefully selected ventures may offer the greatest potential impact and the closest alignment with investor objectives. Social enterprises are for-profit businesses, typically not traded on a stock exchange, that offer an opportunity for multiple bottom-line returns (i. e. , people, planet and profit). To provide effective diversification, we may recommend private equity funds that focus on green technology, local communities, bottom-of-the-pyramid opportunities and/or investing in real assets such as land conservation, sustainable timber, energy efficient real estate, and solar and wind farms.

Investment Values Alignment Quiz

Impact Investing Insights

How to Invest Inherited Money in a Values-Based, Sustainable Way

What do you want to B when you grow up? Our journey into Impact Investing & Becoming a Certified B Corporation

Impact Investing In Renewable Energy

Real Estate Impact Investing: Attractive Returns with Positive Environmental and Social Outcomes

Building a Green Portfolio: How to Get Started

Private Debt Impact Investing: Unlocking Social Change Through Strategic Capital

Impact Investing for Climate Change

Impact Investing in Sustainable Agriculture

Impact Investing in Affordable Housing

The Pros and Cons of ESG Investing

Investing for Impact in the Public Markets: How to Pick a Great ESG Fund

Introduction to Sustainable Investing

Impact Investing FAQs

Impact investing refers to investments made into companies, organizations, and funds with the intention of generating a measurable, beneficial social or environmental impact alongside a financial return. Impact investments provide capital to address global challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, healthcare, and education.

Key characteristics of impact investing include:

- Intentionality: Impact investors actively intend to achieve positive social or environmental outcomes through their investments.

- Return Expectations: Impact investments aim to generate a financial return on capital, which could range from below-market to market rate returns, depending on the investor’s specific objectives.

- Range of Asset Classes: Impact investments can be made in a variety of asset classes, including but not limited to venture capital, private equity, debt, and fixed income.

- Measurement: A hallmark of impact investing is the commitment of the investor to measure and report on the social and environmental performance of their investments, in addition to financial performance.

The concept of impact investing has gained traction as more investors, from individual philanthropists to large institutions, seek to align their investments with their values. While impact investing is distinct from philanthropy, in which donors prioritize social or environmental returns over financial returns, the two can and often do overlap.

The growth of impact investing represents a broader shift towards more sustainable and responsible investment practices, wherein investors increasingly consider the broader consequences of their investment decisions on society and the environment.

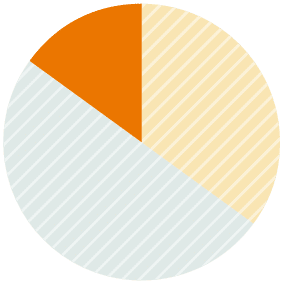

Impact investing and ESG (Environmental, Social, and Governance) investing are both approaches that integrate non-financial considerations into investment decision-making. While they share some common principles, they differ in their objectives, strategies, and evaluation metrics. Here are the primary distinctions between the two:

- Objective:

- Impact Investing: The primary goal is to create a measurable, beneficial social or environmental impact alongside a financial return. Impact investments are often made in specific projects or initiatives that can demonstrate a direct effect.

- ESG Investing: The primary goal is to integrate environmental, social, and governance factors into the investment decision-making process. ESG investing is driven by the belief that addressing these factors can reduce risk and potentially improve returns. The focus is more on the operations and behaviors of companies than on direct impact outcomes.

- Approach:

- Impact Investing: This approach often targets specific projects or enterprises that have a clear mission to address social or environmental challenges. Examples might include investments in affordable housing, renewable energy projects, or education initiatives.

- ESG Investing: This approach evaluates companies based on their environmental, social, and governance practices. An ESG investor might choose companies that have a good record on issues like climate change, labor practices, and corporate governance.

- Measurement:

- Impact Investing: The emphasis is on measuring and reporting the direct social or environmental outcomes of the investments. For instance, how many tons of CO2 emissions were avoided or how many people were provided with clean drinking water as a result of the investment.

- ESG Investing: The focus is on assessing companies’ practices and behaviors in relation to environmental, social, and governance criteria. There might be metrics like carbon footprint, gender diversity in leadership, or policies on bribery and corruption.

- Scope:

- Impact Investing: While it can be broad, impact investing often has a more narrow or specific focus on particular challenges or sectors.

- ESG Investing: ESG is a broader approach that can be applied across industries and asset classes. Any company, regardless of its industry, can be evaluated based on its ESG performance.

- Financial Returns:

- Impact Investing: Returns can vary widely, from below-market to market rate, depending on the investor’s objectives. Some impact investors might be willing to accept lower returns in exchange for higher social or environmental impact.

- ESG Investing: The premise is that integrating ESG factors can help investors make more informed decisions and potentially identify risks and opportunities that aren’t captured by traditional financial analysis. There isn’t necessarily a trade-off between ESG considerations and financial returns.

In summary, while both impact investing and ESG investing focus on creating positive change and promoting sustainability, their methodologies, objectives, and areas of focus can differ. It’s also worth noting that the boundaries between these strategies are sometimes fluid, and an investor might engage in both approaches simultaneously or integrate aspects of both into their investment strategy.

Various stakeholders benefit from impact investing, spanning from individual beneficiaries to the broader global community. Here’s a breakdown of who benefits:

- Targeted Beneficiaries:

- Depending on the nature of the investment, direct beneficiaries might include communities that gain access to clean water, patients who receive affordable medical treatments, families that move into affordable housing, students who obtain education through innovative platforms, or regions that benefit from renewable energy projects.

- Investors:

- Financial Returns: Impact investors stand to gain a financial return on their investments. The level of return can vary widely based on the investor’s objectives, ranging from below-market to market-rate returns.

- Alignment with Values: Impact investing offers investors the opportunity to align their financial strategies with their personal, organizational, or institutional values, thus offering emotional or moral satisfaction.

- Risk Management: Investing in ventures that actively seek to make positive social or environmental impacts can sometimes lead to lower long-term risks, especially as global challenges intensify and regulations tighten.

- Enterprises and Initiatives:

- Organizations, startups, and projects that have a positive social or environmental mission often struggle to obtain funding from traditional sources. Impact investments provide these entities with the crucial capital they need to scale their operations and enhance their impact.

- Local Economies:

- As funds are directed towards positive initiatives, local economies can benefit through job creation, enhancement of infrastructure, and stimulation of secondary and tertiary industries.

- Broader Environment:

- Many impact investments are channeled towards environmental conservation, sustainable agriculture, and renewable energy. These investments contribute to the protection and rejuvenation of ecosystems, the reduction of carbon emissions, and the mitigation of climate change effects.

- Societal Systems:

- Systemic issues such as gender inequality, lack of education, and health disparities can be addressed through impact investments. As solutions are funded and scaled, society at large benefits from more equitable, resilient, and efficient systems.

- Global Community:

- As impact investing addresses United Nations Sustainable Development Goals (SDGs) and other global challenges, the broader global community benefits. Solutions funded by impact investments can often be scaled or adapted for other regions, creating a ripple effect of positive change.

- Traditional Financial Sector:

- As the impact investing market grows, traditional financial institutions that adapt to offer impact investment products and services can benefit by attracting capital, particularly from younger generations and individuals who prioritize sustainable investing.

It’s important to note, however, that the efficacy of impact investing can vary. It’s crucial for investors to conduct due diligence to ensure that their investments genuinely create the intended positive impacts and to be wary of “impact washing” where claims of impact are overstated.

Different types of impact investing

Impact investing encompasses a range of strategies and asset classes, allowing investors to align their financial goals with their desire to create positive societal or environmental change. Here are some of the different types of impact investing:

- Thematic Investments: Investments are made based on specific themes or sectors, such as:

- Clean Energy: Investing in renewable energy sources like wind, solar, or hydroelectric power.

- Sustainable Agriculture: Investing in farming practices and systems that are ecologically responsible.

- Water and Sanitation: Investments focused on clean water access and improved sanitation facilities.

- Healthcare: Funding for affordable and innovative health solutions or services.

- Education: Investing in educational platforms, institutions, or technologies that increase access and improve quality.

- Green Bonds: These are fixed-income securities designed to raise capital for projects with environmental benefits. Proceeds from these bonds are earmarked for environmentally-friendly projects.

- Social Impact Bonds (SIBs): A contract where private investors provide upfront capital for public projects that aim to improve social outcomes. If the project achieves its goals, investors receive a return from the government; if not, they bear the financial loss.

- Private Equity and Venture Capital: Investments made directly into private companies (startups or mature firms) that have a clear mission to address social or environmental challenges. This can range from early-stage funding for new startups to growth capital for scaling established enterprises.

- Impact Real Estate: Investment in properties or real estate projects with the intention of generating measurable environmental or social impact alongside a financial return. This might involve developing affordable housing or revitalizing underserved neighborhoods.

- Microfinance: Providing financial services, especially small loans, to low-income individuals or communities that traditionally lack access to conventional banking services. This helps spur entrepreneurship and economic activity in underserved areas.

- Community Investment Funds: These funds channel capital to underserved communities, supporting initiatives such as local small businesses, community development, or infrastructure projects.

- Fixed Income and Debt Instruments: Loans, notes, or bonds that offer borrowers capital in return for periodic interest payments, with the funds being used for projects that have a positive social or environmental impact.

- Sustainable ETFs (Exchange Traded Funds): ETFs that track indexes of companies operating sustainably or those addressing particular environmental or social challenges.

- Environmental Conservation: Investments focused on preserving or rehabilitating natural habitats, protecting endangered species, or supporting sustainable forestry and fisheries.

- Outcome Funds: These funds tie investment returns to specific measurable outcomes. If the intended social or environmental outcomes are achieved, the investor gets a return; if not, returns may be diminished.

It’s worth noting that the line between traditional investing and impact investing can sometimes be blurred, especially as mainstream financial markets increasingly recognize the value of considering environmental, social, and governance (ESG) factors. As always, due diligence is essential to ensure investments align with both financial objectives and desired impact outcomes.

Measuring the impact of impact investing is crucial to ensure that the investments are genuinely creating the intended positive outcomes and to maintain the credibility and trustworthiness of the impact investing field. There are several frameworks, standards, and tools that have been developed to assess and report on the social and environmental impacts of investments. Here’s how the impact is typically measured:

- Setting Clear Objectives: Before any measurement can occur, investors must define what they hope to achieve. This means setting clear, specific, and measurable impact objectives.

- Choosing Relevant Metrics: Depending on the impact objective, investors select metrics that are relevant to the sector, geography, or issue they’re addressing. For instance, if the investment is aimed at improving education, relevant metrics might include student enrollment rates, graduation rates, or test scores.

- Use of Standardized Frameworks:

- IRIS (Impact Reporting and Investment Standards): Developed by the Global Impact Investing Network (GIIN), IRIS provides a set of standardized metrics to measure social, environmental, and financial performance.

- SDGs (Sustainable Development Goals): Some investors align their impact goals with the United Nations’ SDGs and use them as a framework for measurement.

- GRESB (Global ESG Benchmark for Real Assets): Used for real estate and infrastructure investments, GRESB assesses the environmental, social, and governance (ESG) performance of assets around the world.

- Data Collection: This involves gathering data on chosen metrics. Data can be quantitative (like the number of jobs created) or qualitative (like case studies or stories).

- Comparing to Benchmarks or Baselines: For an investment’s impact to be meaningful, it often needs to be compared against a benchmark or baseline. This could be a previous state (before the investment was made) or a comparison group.

- Use of Third-Party Audits or Certifications: Some impact investors seek external verification or certification to validate their impact. Organizations like B Lab, which certifies B Corporations, assess companies for social and environmental performance, accountability, and transparency.

- Continuous Monitoring and Feedback: Impact measurement isn’t a one-time event. Investors often monitor performance over time, adjusting strategies based on feedback to ensure the desired impact is achieved.

- Reporting: Sharing results is a crucial aspect of impact investing. Transparent reporting helps build trust with stakeholders, attract more capital to impactful projects, and fosters a culture of accountability in the industry.

- Stakeholder Engagement: Engaging with beneficiaries and other stakeholders can provide valuable insights into the effectiveness and relevance of the impact strategies and interventions.

- Addressing Negative Outcomes or Unintended Consequences: Impact assessments should also be vigilant about identifying any negative or unintended consequences of investments. By recognizing these, investors can make necessary adjustments to their strategies.

While there are many tools and standards for measuring impact, the field is still evolving. One challenge is the potential for “impact washing,” where claims of positive impact are exaggerated or misleading. Therefore, rigor, transparency, and a commitment to genuine positive change are vital for effective impact measurement.

Social impact investing, often simply referred to as “impact investing,” is a form of investment that seeks to generate both a measurable social (or environmental) benefit and a financial return. The “social” in social impact investing highlights the goal of creating positive change in societal issues, although many impact investments also consider environmental objectives.

Here are some key features and aspects of social impact investing:

- Dual Objectives:

- Social Return: Achieving a measurable positive change in social challenges such as healthcare, education, affordable housing, financial inclusion, and more.

- Financial Return: Unlike traditional philanthropy, where the primary aim is charitable and no financial return is expected, social impact investing expects some level of financial return, which can range from below-market to market-rate returns.

- Intentionality: A distinguishing feature of social impact investing is the intention to create a positive social impact. Investors are not just passively avoiding harm or mitigating risks; they actively seek to contribute to societal betterment.

- Measurable Outcomes: An integral part of social impact investing is the ability to measure and report on the social outcomes achieved. Using various tools and frameworks, investors track the efficacy of their investments in creating the desired impact.

- Range of Asset Classes and Instruments: Social impact investments can be made across various asset classes, from private equity and venture capital to bonds, real estate, and more.

- Diverse Sectors: While social impact investing can encompass numerous sectors, some common areas of focus include healthcare (e.g., affordable medical services or innovations), education (e.g., educational technologies or institutions serving underprivileged communities), financial services (e.g., microfinance institutions), and affordable housing.

- Stakeholder Engagement: Engaging with beneficiaries and other stakeholders is often an integral part of the investment process. This engagement ensures that investments are aligned with the needs and aspirations of the communities they aim to serve.

- Rigorous Due Diligence: Before committing funds, impact investors typically undertake a thorough examination of potential investments to understand both the likely social impact and the financial risk and return.

In essence, social impact investing represents a shift from the traditional investment paradigm, where decisions are made solely based on financial returns, to a more holistic approach that values both financial performance and positive societal change. It’s a growing field that attracts a wide range of investors, from individual philanthropists to large institutional investors.

Sustainability and impact investing are both investment approaches that consider social, environmental, and financial outcomes. However, they have distinct focal points and motivations. Here are the key differences between sustainability and impact investing:

- Primary Focus:

- Sustainability: The focus is on long-term resilience and environmental stewardship. Sustainable investments prioritize companies or projects that demonstrate practices that ensure longevity and reduce environmental degradation, often integrating Environmental, Social, and Governance (ESG) factors. These investments might avoid businesses with harmful environmental practices or those involved in industries like tobacco or weapons.

- Impact Investing: This approach actively seeks to create a positive social or environmental impact alongside a financial return. Impact investments target specific positive outcomes, such as clean water access, affordable housing, or renewable energy deployment. The intentionality of creating positive change is a hallmark of impact investing.

- Measurement and Reporting:

- Sustainability: Often uses ESG metrics to evaluate and report on the sustainability and ethical practices of an investment. ESG integration might involve assessing company performance across environmental stewardship, social responsibility, and governance criteria.

- Impact Investing: Goes beyond ESG metrics to also measure the tangible positive impact generated by the investment. Impact investors might use tools like the Impact Reporting and Investment Standards (IRIS) or align their goals with the United Nations Sustainable Development Goals (SDGs).

- Financial Objectives:

- Sustainability: Sustainable investing primarily aims for market-rate returns, emphasizing that sustainable practices can lead to better long-term financial performance due to reduced risks and potential for innovation.

- Impact Investing: Financial return objectives can vary widely, from seeking below-market rates in exchange for high social impact to targeting market-rate returns. The key is that there’s an explicit expectation of generating measurable positive impact alongside financial returns.

- Engagement and Strategy:

- Sustainability: May involve strategies such as negative screening (excluding harmful industries), positive screening (selecting companies with strong ESG performance), or thematic investing (e.g., a focus on green technologies).

- Impact Investing: Often involves more proactive engagement, with investors directly funding projects, startups, or initiatives that have a clear mission to solve specific social or environmental problems.

- Investor Base:

- Sustainability: Given the integration of ESG factors, sustainable investing has gained traction among institutional investors, mutual funds, and mainstream financial institutions.

- Impact Investing: While also attractive to institutional investors, impact investing has a strong base among philanthropic foundations, high-net-worth individuals, and entities explicitly focused on addressing global challenges.

In summary, while both sustainability and impact investing prioritize social and environmental considerations, they differ in their primary objectives, measurement approaches, and strategies. Both are components of the broader responsible investing movement, which seeks to integrate non-financial criteria into investment decisions to achieve long-term value creation and positive change.

“Impact investing” refers to investments made with the intention to generate both a measurable social or environmental impact alongside a financial return. The question of whether impact investing “works” can be dissected from two primary angles: its ability to generate the desired impact and its ability to provide financial returns.

- Impact Objectives:

- Positive Outcomes: There are numerous examples of impact investments leading to tangible social or environmental outcomes, such as increased access to healthcare, improved educational outcomes, reduced carbon emissions, and habitat preservation.

- Measurement Challenges: Measuring social or environmental impact can be complex and varies by sector, geography, and the nature of the investment. Not all impact investments achieve their intended outcomes, and the efficacy of some projects can be debated.

- Unintended Consequences: As with any investment, there can be unintended negative side effects. For instance, while microfinance can empower entrepreneurs, there have been instances of over-indebtedness or unscrupulous lending practices.

- Financial Returns:

- Variability: The financial returns from impact investments can vary widely. Some investments may offer market-rate returns, while others may be structured to provide below-market returns in consideration of the social or environmental benefits they generate.

- Risk and Reward: Like traditional investments, there’s no guarantee of returns in impact investing. Some impact investments may perform exceptionally well, while others might underperform or even result in a loss. However, the diversification and unique market opportunities presented by impact investments can sometimes offer compelling risk-adjusted returns.

- Growing Market: The impact investing market has been growing, indicating increased investor interest and the potential for more mature and sophisticated investment opportunities.

- Broad Market Trends:

- Mainstreaming: As traditional investors and large financial institutions increasingly incorporate impact and ESG (Environmental, Social, and Governance) criteria into their investment processes, the lines between traditional and impact investing have started to blur.

- Increased Scrutiny: With the rise of impact investing, there has also been a rise in “impact washing” – cases where investments are labeled as “impactful” without substantive evidence or genuine intentionality. This underscores the importance of rigorous impact measurement and third-party verification.

In summary, while impact investing has demonstrated significant potential in addressing global challenges and generating financial returns, its effectiveness is nuanced and can vary based on a myriad of factors, including the specific investment, the region, the sector, and the rigor of the management approach. As with any investment strategy, due diligence, continuous monitoring, and transparency are essential to optimize outcomes.