RETIREMENT Planning

Embarking on your retirement journey marks a pivotal chapter in your life. It often opens new possibilities for relaxation, recreation, adventure, volunteerism, travel, and spending more time with those you love.

Our approach to retirement planning starts with a deep dive into understanding what you value and where you find meaning. As our runways get shorter, time can feel more precious, and priorities may shift.

Whether you decide to fully retire on a specific date, much like flipping an “on/off switch” or to gradually cut back, like sliding a “dimmer switch”, we can help you think through the opportunities and challenges that lie ahead.

Recognizing that retirement is a significant life transition, we are here to ensure that your plan evolves with you, offering support, insight, and guidance every step of the way.

An Evolving View of Retirement

As wealth has grown, life expectancies have increased, the expected length of the retirement period has expanded and lifestyles have become more active.

Traditionally, “Retiring” meant working full-time until about age 65 and then relaxing and pursuing other interests. A newer and evolving idea that is gaining popularity is called “Rewiring”, which focuses more on creating a fulfilling and balanced life after a full-time career, with a focus not on stopping work altogether but on reshaping life to align with personal values, goals, and passions. This approach allows individuals to maintain a sense of purpose, stay physically and mentally active, and continue contributing to society in meaningful ways.

Creating Balance in Today’s World

Your Money or Your Life.

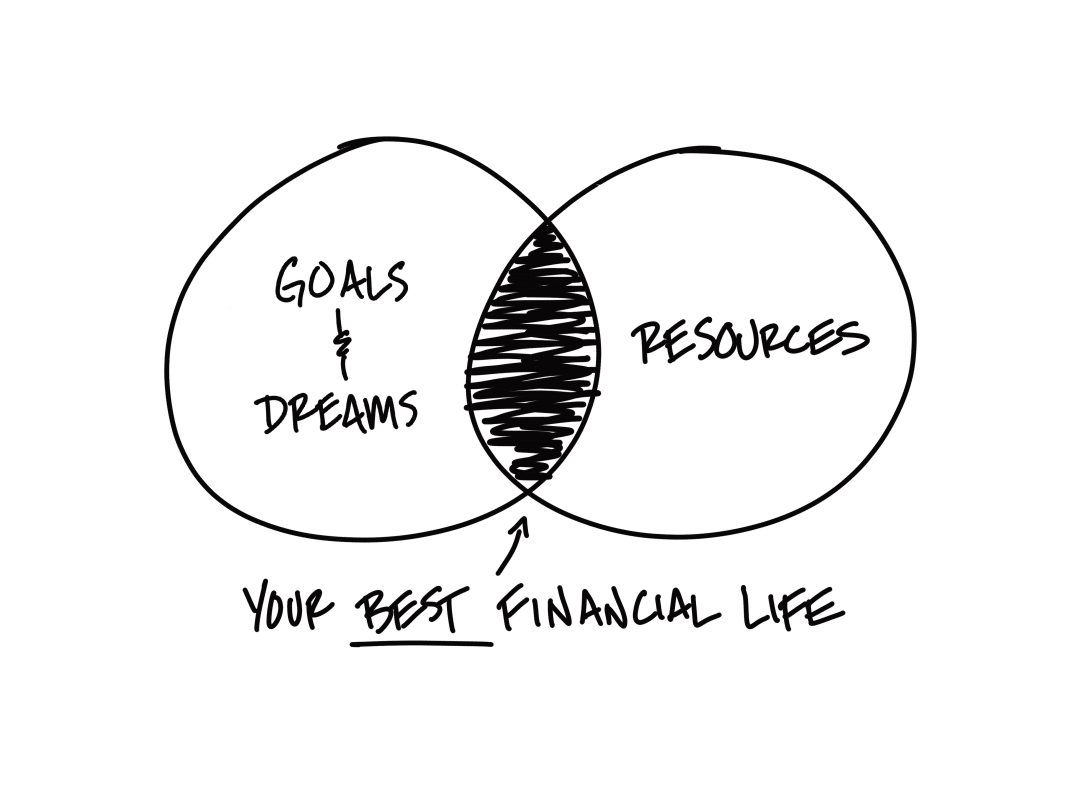

Whether you decide to fully retire or transition to part time work, our services are designed to directly address your personal goals and circumstances. Our approach balances financial wisdom with the pursuit of staying connected, active, and purposeful. For example, we have written about the attractiveness of strategies like working remotely from preferred locations in order to harmonize professional and personal interests. This not only fosters personal growth but also acknowledges the desire of many to remain engaged in work to some extent, offering a more satisfying phase of life as priorities change. A great realization for many is that not every decision you make has to be the “best financial decision”, it just needs to be the “best overall decision” –one that brings you joy and satisfaction and still makes sense financially.

Transition Planning

Smoothing your transition into retirement.

Transitioning from a career into gradual or full retirement is a significant life change. We provide many forms of support during this transition, focusing on both your financial preparations and your emotional and psychological readiness.

This includes planning for phased retirement, business succession, financial lifestyle changes, and smoothing the transition from a saving to spending mindset.

Customized Retirement Income Strategies

Ensuring you have an income that lasts.

We create customized income strategies that focus on providing a steady flow of funding through retirement. By analyzing your retirement savings, pension plans, Social Security benefits, rental real estate holdings and other income sources, we develop risk appropriate, cost effective and tax efficient plans with the goal of providing clients with a comfortable and sustainable lifestyle throughout their retirement years.

Social Security Optimization

Making the most of your benefits.

Deciding when to start taking Social Security is a critical decision. We help you understand various strategies and timing options to maximize your Social Security benefits based on your individual circumstances, work history, life expectancy and retirement goals.

Healthcare and Long-Term Care Planning

Preparing for future healthcare needs.

Retirement Account Management

Investing wisely.

Navigating the complex world of retirement accounts (like IRAs, 401(k)s, and annuities) can be challenging. We provide expertise in managing these accounts, including advice on contribution levels, investment choices, Roth conversions, withdrawal strategies, and tax implications, to help make the most of your assets during your post-career years.