Evidence-BasedInvestment Management

Our approach to investing is to focus on what works, what makes sense, and what we can control. Our evidence-based investment approach is backed by research from respected industry leaders (see details below). We do not trade excessively, pick individual stocks, or pretend to know the future. We believe that it is time in the market, not market-timing, that maximizes client returns.

There are six key components to our investment management approach:

Diversification

Diversification is our mantra.

Cost Saving / Indexing

We vigorously pursue opportunities to save you money.

Tax Efficiency

It’s not just what you make on your investments, but what you keep that matters.

We strive to minimize your taxes by: 1) using securities that generate tax-exempt and tax-sheltered income, 2) managing trading activity to shelter or defer gains, and 3) prioritizing investments that generate tax-advantaged income and gains. We also help clients to take advantage of the benefits of tax-sheltered education plans, retirement accounts and other tax-advantaged vehicles.

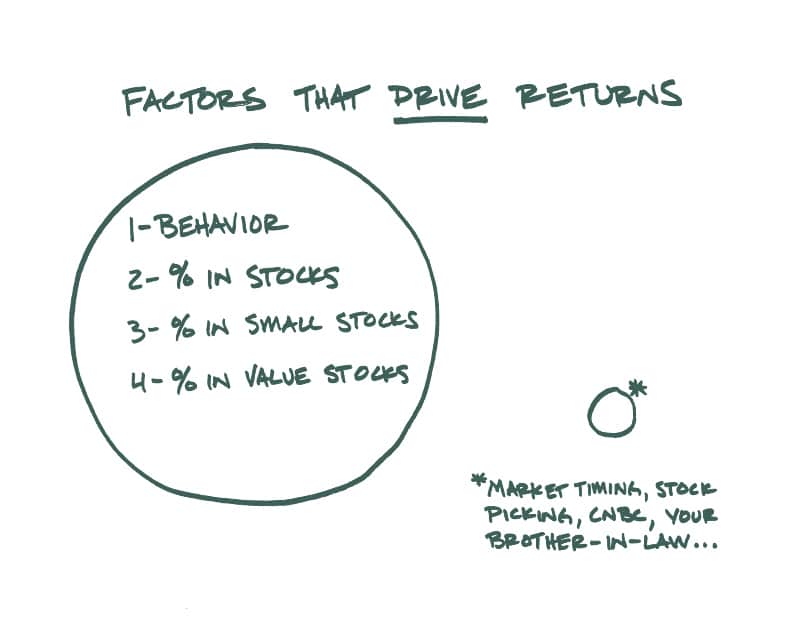

Factor-Based Investing

We emphasize portfolio characteristics (factors) that have historically added to returns or reduced investment risk.

Risk Management

We customize your portfolio to your risk tolerance.

For each client, we work to find the right balance of safety and growth. We utilize sophisticated tools to help optimize and stress test portfolios. We reduce risk through broad diversification. Utilizing a wide variety of different types of investments, including assets like real estate and private offerings, helps smooth out returns and lower volatility (risk).

Portfolio Rebalancing

We periodically sell a portion of those asset classes that have appreciated the most and buy more of those that appreciated the least to bring portfolios back in line with target allocations.

1 Determinants of Portfolio Performance by Gary P. Brinson, CFA, Randolph Hood, and Gilbert L. Beebower

2 Portfolio Selection, Harry Markowitz

3 S&P Global: SPIVA® (S&P Index Vs. Active)

4 Common risk factors in the returns on stocks and bonds, Eugene F. Fama & Kenneth R. French, and Assessing Risk through Environmental, Social and Governance Exposures, Jeff Dunn, Shaun Fitzgibbons, Lukasz Pomorski

5 To Rebalance or Not to Rebalance, Gene Podkaminer & Wylie Tollette, Franklin Templeton