Economic Outlook

Overview

Last year brought extraordinary challenges. It began with the war in Ukraine, which contributed to a massive energy price shock ($115/barrel in June), the highest inflation in 40 years (9.1%, also in June), a sea change in interest rates, and economic growth falling almost 50% (from roughly 6% in 2021 to 3.2% in 2022). China’s zero-Covid policy, which finally ended this month, was a major contributor to the global economic slowdown. So was the Fed, which raised U.S. interest rates at the fastest pace in history in its efforts to curb inflation.

The dollar soared, crypto-currencies collapsed (bitcoin lost 65%), and for perhaps the first time in more than a century, both US stock and bond markets experienced double digit losses. These trends generally reversed themselves in the 4th quarter as it became increasingly apparent that inflation levels were finally declining. U.S. stocks gained 7% during the quarter to end the year down 19%, while U.S. bonds rose 2%, ending the year down 13%. According to financial historian Edward McQuarrie, it was the worst year ever for the bond market.

Despite surprisingly strong employment and GDP figures in the second half of 2022, it is widely expected that the U.S. may slip into a recession in 2023. The Fed remains hawkish, projecting that it will raise interest rates to a little over 5% by midyear to continue cooling the economy.

*Notes. The current GDP estimate is the January 5th GDPNow figure from the Atlanta branch of the Fed. Other 12/31/22 data is from the latest available release, which may be from the prior month. Fed Funds rate is the lower end of target range

CCM Key Economic Indicators

Indicator

12.31.22*

9.30.22

12.31.21

U.S. Economy

Quarterly GDP Growth

Est. 3.8%

3.2%

7.0%

Unemployment Rate

3.5%

3.5%

3.9%

U.S. CPI (Core)

5.7%

6.7%

5.5%

Interest Rates

Fed Funds Rate

4.25%

3.0%

0.0%

10-Year Treasury Rate

3.6%

3.5%

1.5%

Currency & Commodities

Crude Oil (WTI)

$80.16

$79.91

$75.33

Gold Price

$1,812

$1,673

$1,820

Trade Weighted Dollar

122.3

125.8

115.8

Confidence

Consumer Confidence Index

108.3

107.8

115.2

ISM Purchasing Managers Index

48.4

50.9

58.8

Stock Prices

Dow Jones Industrial Average

33,147

28,725

36,338

S&P 500 Forward P/E ratio

16.7

15.1

21.2

GDP

Real GDP grew at an impressive 3.2% annualized rate in the third quarter. While most forecasters expect annualized GDP growth for the 4th quarter to come in around 1%, the Atlanta Fed is currently projecting closer to 4% growth. Low unemployment has helped fuel wage gains and consumer spending, which is in turn the major driver of GDP. However, at some point the rapid increase in interest rates by the Fed has to start weighing more heavily on economic activity. Growth is widely expected to stall during the first half of 2023, which may result in a mild recession.

Employment

Despite the Fed’s actions, U.S. employment has been remarkably resilient, with many employers competing for the limited pool of available workers. The current unemployment level of 3.5% matches the 2020 pre-pandemic low, a rate which hadn’t been reached before then for more than 50 years. However, we are starting to see an increasing number of high-profile layoffs, especially at tech companies like Meta (Facebook), Twitter, Salesforce and Cisco. Goldman Sachs also recently announced an 8% staff reduction. With the Fed still seeking to meaningfully slow the economy, we would not be surprised to see unemployment rise to the 4.5% to 5% level in the next year or so, which could mean the painful loss of over one million jobs.

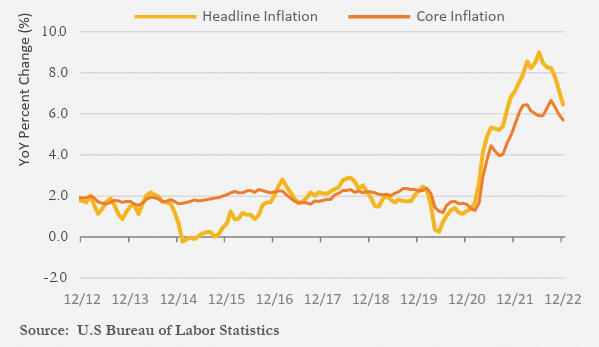

Inflation

Inflation in the U.S. reached its highest level in 40 years. Prices jumped as surging consumer demand— fueled by very low-interest rates and government stimulus—collided with limited supply caused by pandemic-related disruptions. Russia’s invasion of Ukraine further inflamed inflation by pushing up global prices for energy, wheat and other commodities. The annual (rolling 12 month) rate of headline inflation peaked at 9.1% in June, before dropping to 8.2% in September and 7.1% in November. Even more notable is the decline in month-to-month inflation rates which fell dramatically after mid-year (see below).

Annual Inflation (Consumer Price Index)

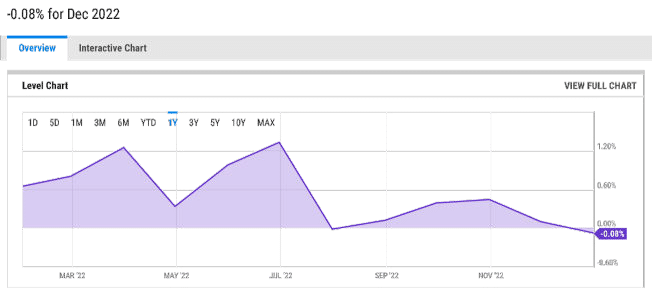

Monthly (Headline) Inflation

The drop in the monthly inflation numbers is likely heavily influenced by the recent decline in energy prices and the slowing of the housing market, factors which haven’t yet fully shown up in the annual numbers. This data suggests the Fed is succeeding in its battle against inflation, although the war may not be over. Remaining concerns include wages continuing to rise in a tight labor market and increased demand and accompanying supply shortages as China reopens its economy.

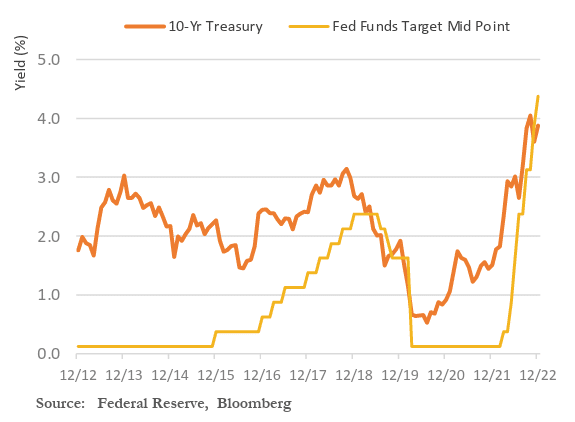

Interest Rates

The Federal Reserve (Fed) remains committed to bringing inflation back down to the 2% level and expects to continue raising interest rates to do so. After initially believing that inflation pressures were transitory and thus waiting too long to start raising rates, the Fed then initiated the fastest rate increase in history. Through a series of 7 increases last year, it raised its target rate range from 0-.25% at the beginning of 2022 to 4.25-4.5% by year end.

It currently expects rates to reach the 5.0-5.25% range by March and for them to remain at that level for the remainder of the year. Once it is convinced that inflation is under control, the Fed could pivot and commence an easing cycle starting in early 2024.

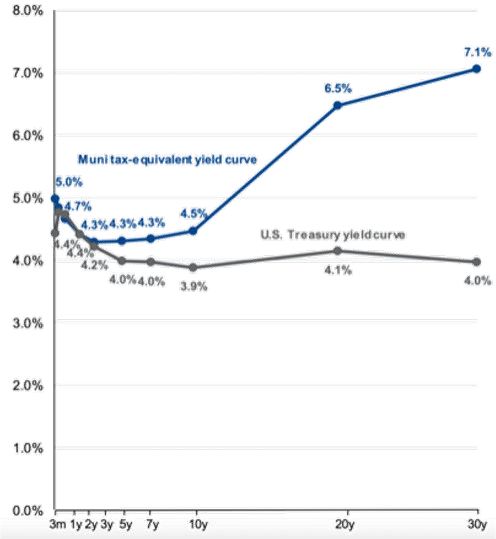

Short term interest rates now significantly exceed longerterm rates, a condition that is referred to as an inverted yield curve, which can be a signal of a forthcoming recession.

10-Yr U.S. Treasury Yield vs. Federal Funds Target Rate

Consumer & Business Confidence

Consumer confidence has risen sharply since June, but is still well below its pre-pandemic highs. Despite falling real incomes, households have continued to spend. Credit card debt has increased, and savings rates have fallen below 3%, the lowest level since 2005. Business confidence, in contrast, has continued to decline. The Purchasing Managers Index is now at a level (below 50) that suggests an economic contraction.

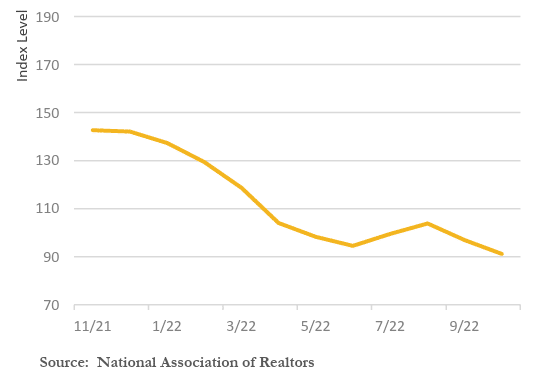

Housing & Commercial Real Estate

Existing home sales dropped by 33% during 2022. This is one of the biggest impacts of the Federal Reserve’s aggressive interest rate increases. Home sales are highly interest-rate sensitive and fuel other economic activities such as spending on renovations, furniture, and appliances. The housing market slowdown could persist well into 2023 as homebuying affordability remains near its lowest level in decades. After soaring for the past few years and peaking in June, U.S. home prices have generally leveled out and may decline in the next year.

We are seeing more significant declines in commercial real estate prices as dramatically higher interest rates and more restrictive lending criteria take their toll. For example, for the purposes of valuing its shares, the Blackstone REIT, one of the largest commercial real estate funds in the country, lowered the multiple (cap rate) at which it assumes it will sell its properties by 11% this year.

Housing Affordability Index

International Outlook and the Dollar

The United States is not the only economy with an inflation problem at present. Inflation has risen sharply in most foreign economies as well, and central banks in those countries have faced the same dilemma as the Federal Reserve. Like their counterparts at the Fed, policymakers at many foreign central banks could choose to bring inflation down at the expense of the labor market. Consequently, many foreign economies will likely also experience real GDP contractions in 2023. Moreover, the downturns in the Eurozone and the United Kingdom could be especially pronounced.

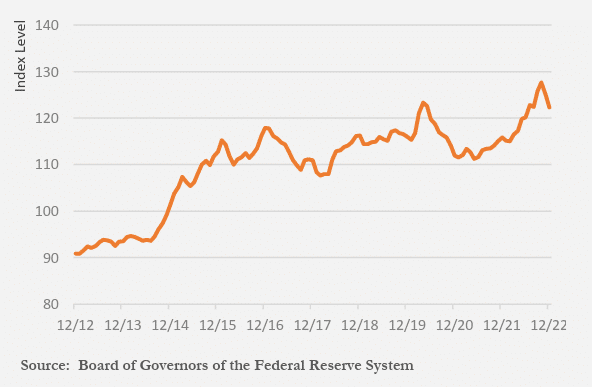

The U.S. dollar strengthened significantly (5.6% on average) against most foreign currencies during 2022, although the appreciation was higher before the 4th quarter. This trend of appreciation should continue through the early part of 2023. But as the Fed brings its tightening cycle to an end and as market participants begin to anticipate eventual policy easing in the United States, the dollar should begin to trend lower later in the year.

This should take pressure off many foreign currencies, particularly currencies in the developing world, where several countries are facing elevated default risk due to having to repay their debt in dollars. This turnaround could contribute to emerging market outperformance in 2023.

U.S. Dollar Trade-Weighted Index

Europe

China & Emerging Markets

Europe—not just the Eurozone, but also the United Kingdom—has appeared to be on the brink of entering a prolonged period of recession that is expected to last for much of 2023. A European recession has stemmed primarily from inflationary pressures and central bank rate hikes, but energy supply disruptions and accelerating wage growth have also compounded the continent’s economic slowdown. These factors may lead to further deindustrialization of Europe, with manufacturing moving to lower cost markets.

After reaching 8.1% in 2021, China’s economic growth was projected in October by the International Monetary Fund to come in at 3.2% in 2022 and 4.4% in 2023. However, the recent end of the zero-Covid lockdown policy and other factors, including a large new fiscal package to support the domestic real estate industry should lead to more consumption and investment in China, and likely to faster growth by mid 2023. The next three largest emerging market economies by market value are India, South Korea & Taiwan. The east Asian countries are major trading partners with China and should benefit from its accelerating economic growth India is independently expected to be among the fastest growing emerging market countries next year with 6% projected real GDP growth. Other than several emerging markets, much of the world may be in recession in 2023.

Capital Markets

2022 was a historic year with both stock and bond markets suffering unique double-digit losses. The largest factors negatively impacting markets included multi-decade high inflation, the Fed’s persistent fight to contain it with eyepopping rate increases, and the promise of more increases to come. The war in Ukraine, divisive partisan politics, a weakening housing market, falling consumer sentiment, talk of recession, and the prospects of declining corporate profits and margins also combined for a toxic brew of negative inputs concerning investors. And the news around the world was gloomy as well with Europe and the U.K. headed for recession and China, the world’s second-largest economy, experiencing much slower annual growth than it is accustomed to.

The fourth quarter provided positive return momentum going into 2023 with both stocks and bonds gaining ground on earlier losses during the year. These gains were not nearly enough to offset the large declines from earlier in the year. U.S. equities finished the year with a positive fourth quarter as the large-cap S&P 500 posted a 7.6% return, the Russell Midcap was up 9.2%, and the small-cap Russell 2000 gained 6.2%. For the full year of 2022 however the S&P 500 was down 18.1%, the Russell Mid Cap was down 17.3%, and the Russell 2000 was down 20.4%.

Stylistically Value stocks resumed their performance dominance over Growth stocks in the fourth quarter. For all of 2022 large, mid, and small-cap Value stocks dramatically outpaced their Growth counterparts continuing a performance trend reversal that began in 2021 (following years of lagging the performance of growth stocks.)

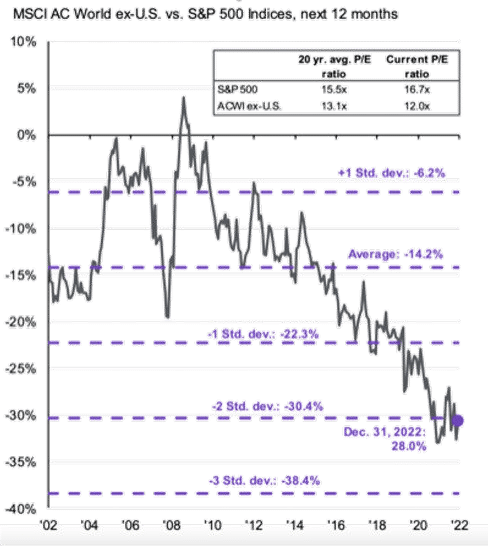

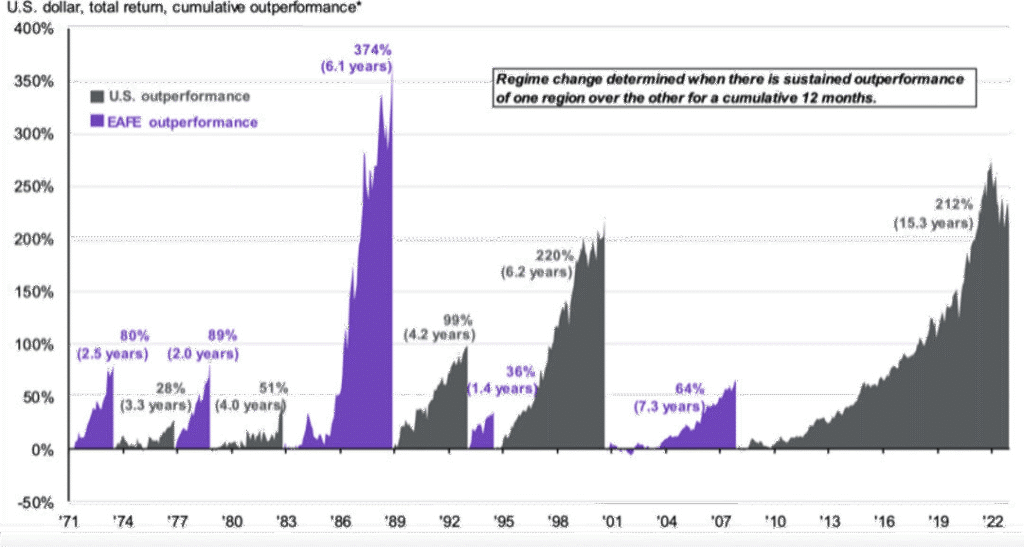

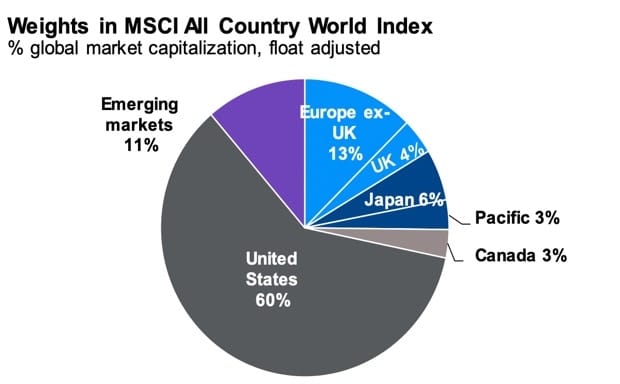

International equities also posted positive returns for the fourth quarter but delivered negative returns for the full year just like domestic stocks. That said, the fourth quarter gains were stronger in overseas markets contributing to international developed market equities outpacing U.S. stocks. For all of 2022, the MSCI All Country World Index exU.S. declined 16% while the MSCI Emerging Markets Index declined 20.1%.

The bond market turned into a sea of red ink in 2022. There was no escaping the downward price pressure on bonds from rapidly rising interest rates. The bond market, sensing the worst was over for the rate hiking cycle, began clawing back some earlier year losses in the fourth quarter. The Bloomberg U.S. Aggregate Index was up 1.9% in the fourth quarter but down 13% for the year.

U.S. Dollar Trade-Weighted Index

Source: JP Morgan

International: Price-to-earnings discount vs. U.S.

Source: JP Morgan

Outlook

The outlook for stocks and bonds has brightened somewhat since last quarter largely due to the likelihood that the Fed is closer to the end of its rate hiking cycle. It takes time however for a Fed rate hike to flow through the economy and show up in changes to corporate revenues, profits, margins, and employment trends. With all the hikes of 2022 behind us but at least a few more potentially on the way, there is still a time lag yet to experience, probably until the end of this year, for the Fed’s tightening cycle to fully impact the economy. Until there is greater clarity on the actual impact on the performance of the economy stocks may well be moving sideways with no clear direction.

There continue to be downside risks to the capital markets which should be kept in mind as 2023 gets underway. Those risks include the Fed pushing the tightening cycle too far, a deeper than-expected recession, contagion which could emerge from an increase in credit defaults as rates continue to rise, and of course a possible escalation in the conflict in Ukraine. These types of events could well lead to elevated market volatility in comparison to recent years – this volatility however often creates new investment opportunities.

A longer-term view of markets suggests the tailwinds stock and bond investors enjoyed for the past decade or more, including massive fiscal stimulus as well as declining and ultra-low interest rates, will not resurface any time soon. Securities values are more likely to be driven by the organic operational successes of businesses. That will likely result in market returns being lower than in the recent past.

Our takeaways on the fixed income side are that bonds offer the most attractive yields we have seen in many years, Treasuries are particularly attractive for short maturities and municipals for longer maturities.

On the equity side, we believe that international is undervalued relative to the U.S. and that emerging markets offer the highest long-term growth and return potential. Foreign investments should be further aided by an expected drop in the dollar. High interest rates and tighter lending practices will likely impair real estate values.

Last year the U.S. made up about 4% of the world’s population and 24% of global GDP, along with 60% of the global stock market. The current U.S. share of the global equity market is well above the postwar norm. We expect the balance to shift more towards equilibrium over time, which means more appreciation from foreign than domestic markets.

MSCI EAFE and MSCI USA relative performance

Source: JP Morgan

Weights in MSCI All Country World Index

Source: JP Morgan

Sources: Capital Market Consultants, Bloomberg, Department of Labor, Department of Commerce, Morningstar, CNN, World Bank,

International Monetary Fund, JP Morgan, Blackstone, National Association of Realtors.