Economic Outlook

Overview

U.S. real economic growth (GDP) for 2023 is expected to come in at a stronger than average pace of approximately 2.8%. After all of the interest rate increases over the last two years, it was widely expected that the economy would shrink this year and enter a recession, but growth remained robust. Cheered by the prospects of a soft landing (the Fed getting a handle on inflation without causing a recession), the stock and bond markets both recorded healthy gains. However, some signs of economic weakness have started to emerge, particularly in the labor and housing markets. Slower economic growth is expected in 2024.

The news that dominated headlines in the last year included inflation and interest rates, the banking crisis and the indictments against former President Trump, and the wars in Ukraine and Israel/Gaza. In 2024, attention will be focused on the upcoming U.S. presidential election, which appears likely to be a bitterly contested rematch of the prior election.

*Notes. The current GDP estimate is the January 18th GDPNow figure from the Atlanta branch of the Fed. Other 12/31/23 data is from the latest available release, which may be from the prior month. Fed Funds rate is the lower end of target range

CCM Key Economic Indicators

Indicator

12.31.23*

9.30.23

12.31.22

U.S. Economy

Quarterly GDP Growth

Est 2.4%*

4.9%

2.6%

Unemployment Rate

3.7%

3.8%

3.5%

U.S. CPI (Core)

3.9%

4.1%

5.7%

Interest Rates

Fed Funds Rate

5.25%

5.25%

4.25%

10-Year Treasury Rate

4.02%

4.38%

3.62%

Currency & Commodities

Crude Oil (WTI)

$71.89

$90.77

$80.16

Gold Price

$2,062

$1,871

$1,812

Trade Weighted Dollar

120.2

122.0

122.2

Confidence

Consumer Confidence Index

110.7

104.3

109.0

ISM Purchasing Managers Index

47.4

49.0

48.4

Stock Prices

Dow Jones Industrial Average

37,689

33,507

33,147

S&P 500 Forward P/E ratio

19.5

17.8

16.7

GDP Growth

The final reading on U.S. GDP showed that the economy grew at a remarkably strong 4.9% annualized rate in the third quarter. A surprise increase in November retail sales helped dispel lingering pessimism about the economy and reinforced growing sentiment that the U.S. could beat inflation without paying the price of significantly weaker growth. Overall, consumer spending remained buoyant over the holiday period, but the momentum may be fading, with consumption growth likely to slow in the first quarter. The Institute of Supply Management’s surveys of both purchasing managers and service industries resulted in mid-range readings that suggest fairly lackluster growth. Overall, we expect to see much more moderate GDP growth going forward. The Fed is currently projecting 1.5% GDP growth for 2024.

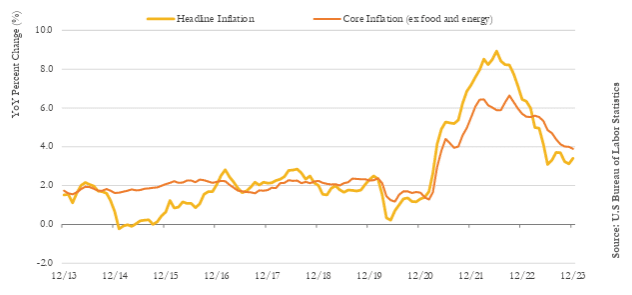

Inflation

Annual inflation eased considerably in 2023 amid tight monetary policy. Headline inflation started the year at 6.4% and dropped to 3.1% in November before increasing to 3.4% in December. Core inflation, which excludes the volatile food and energy sectors, has also been trending downward, ending the year at 3.9%.

Price increases for both goods and services slowed during the year. Smoother functioning supply chains, and restrained consumer spending helped slow price increases for goods. Despite continuing strong demand, service prices also cooled. Outright declines in energy prices put the biggest dent in inflation over the past year, but price growth has slowed for other major categories, including food, housing, core goods and core services.

While inflation should recede further, additional progress toward the Fed’s 2% goal is likely to prove slower going than it has over the past year. This could thus lead to interest rates staying close to current levels for longer than expected.

Inflation (Consumer Price Index)

Labor market

Housing

The resilient labor market that supported an unexpectedly strong U.S. economy last year appears to be weakening. Continuing jobless claims rose to 1.93 million in midNovember, the highest level since late 2021. Demand for temporary help has also declined, and the average work week has fallen back to pre-pandemic levels, signaling slower income growth. Additional cooling is expected in 2024 as job opening levels continue to retreat.

In November, pending home sales fell to an all-time low. And the situation may worsen before it improves. Elevated mortgage rates combined with low levels of existing home inventory for sale have crimped affordability and weighed on sales. The recent pullback in mortgage rates appears to have provided some relief for housing, with mortgage purchase applications ticking higher in the last month of the quarter. However, the impact of interest rates has a lag, so this could take some time to translate to increased sales activity.

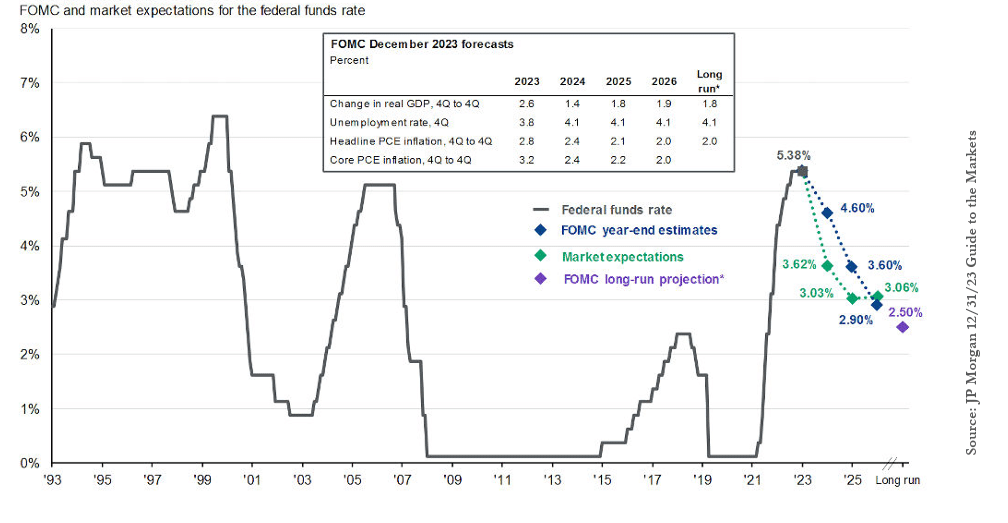

Interest Rates

As inflation cooled, the Fed was able to stop raising rates after July. The general consensus in the market is that rates have peaked, but the Fed will probably not lower rates as fast as the market expects (as illustrated below in green) and could still raise rates if needed to help bring inflation down to its 2% target. Any indication of inflation persisting or increasing could lead the Fed to resume hiking rates again. And even if the tightening cycle is over and rates begin to decline, rates will almost certainly settle at a higher level than the near zero levels that prevailed ahead of the pandemic.

Federal funds rate expectations

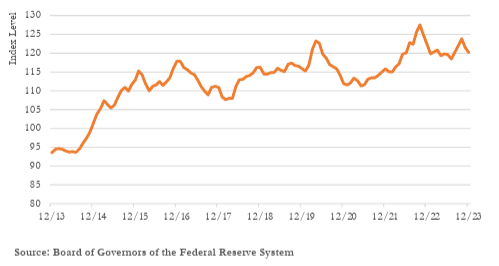

U.S. Dollar

After an extended period of U.S. dollar strength in 2022, it was a back-and-forth year for the dollar in 2023. The outlook for the dollar going forward is uncertain, but we may see near term strength against the Euro and the Pound. Due to sharply slowing growth in Europe, central bankers there have likely reached the end of their tightening cycle and may start cutting rates soon. All other things being equal, when foreign rates decline faster than those in the U.S., the dollar typically becomes more attractive to investors and rises in value. The pendulum may swing back towards dollar weakness when the Fed starts cutting rates in the U.S.

U.S. Dollar Trade-Weighted Index

The Global Economy

The global economy grew at an annual rate of 3.5% in 2022, and likely slowed to about 3.0% in 2023. The OECD projects global growth to slow further, to 2.7% in 2024. Growth prospects could be restrained further if recessions occur in the U.S. and/or Europe, or growth slows by more than expected in China.

At least in part due to higher interest rates, economic momentum across Europe has slowed sharply. Purchasing Manager surveys there have fallen to levels that have historically been consistent with a contracting economy. However, real household income trends have held up reasonably well and while Eurozone corporate profit growth has slowed, profits have so far not experienced any significant decline. That said, Eurozone GDP growth has been forecast to be just 0.5% for all of 2023 and below 1% for 2024.

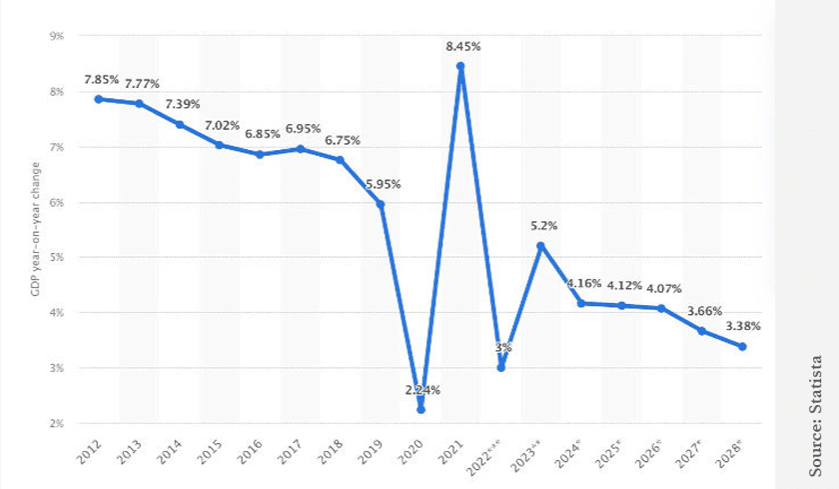

The burst of activity seen in early 2023 in China after the economy reopened post-COVID proved to be relatively shortlived. As seen in the chart below, China’s economy has been slowing over time. Real estate sector problems, demographic challenges, sluggish consumption trends, and geopolitical tensions all will likely place continued downward pressure on growth prospects over the medium to longer term.

Historical and Projected GDP Growth in China

U.S. Economic Outlook for 2024

Interest rates are expected to decline in 2024, but very gradually. They may even increase in real terms (after adjusting for inflation). Although the Federal Reserve’s tightening cycle has probably come to an end, the slow return to 2% inflation suggests the Fed’s Open Market Committee (FOMC) may still be a long way from easing rates.

Consumer spending (the main driver of GDP growth) was strong in 2023 but is expected to slow in 2024. This is because the ability of households to easily rely on their balance sheets to spend has faded. Excess liquidity has dried up and become concentrated among higher-income households that have a lower propensity to spend. Access to credit has also weakened as banks have become more cautious in making new loan commitments to consumers, portending a pullback in overall revolving credit.

Real GDP growth could thus slow materially in 2024 and a modest contraction in economic activity is still a possibility, although a soft landing remains the most likely scenario.

Market Update

Stock markets across the globe posted spectacular December returns which added to the substantial gains achieved through the first 11 months of the year. Bond markets too posted solid gains last month providing investors a healthy return for the full year after a difficult 2022. Markets have responded strongly to the surprising resilience of the U.S. economy and its labor market, despite the headwinds of still elevated inflation and high-interest rates. The Federal Reserve’s signal that the end of their rate hiking campaign had probably arrived gave markets reason to celebrate.

U.S. stocks across the capitalization and style spectrum delivered robust gains in the fourth quarter. Virtually every capitalization and style type posted double digit gains for the quarter. The S&P 500 was up 11.7%, the Russell Mid Cap Index was up 12.8%, while Small Cap stocks were up 14.1% in Q4. For the full year, the S&P 500 was up 26.3%, while Mid Cap and Small Cap stocks were up 17.2% and 16.8%, respectively. All of these returns are well above historical norms.

The broad Bloomberg Aggregate posted a 6.8% return for the fourth quarter and a 5.5% return for the full year. With signals that the Federal Reserve was likely done hiking rates and their next move was likely a rate cut, long-dated bonds outpaced shorter-term maturities. Bonds with higher credit risk than U.S. Treasuries posted the highest returns with corporate bonds up 8.2% and high-yield bonds gaining 7.2% for the quarter.

Outlook

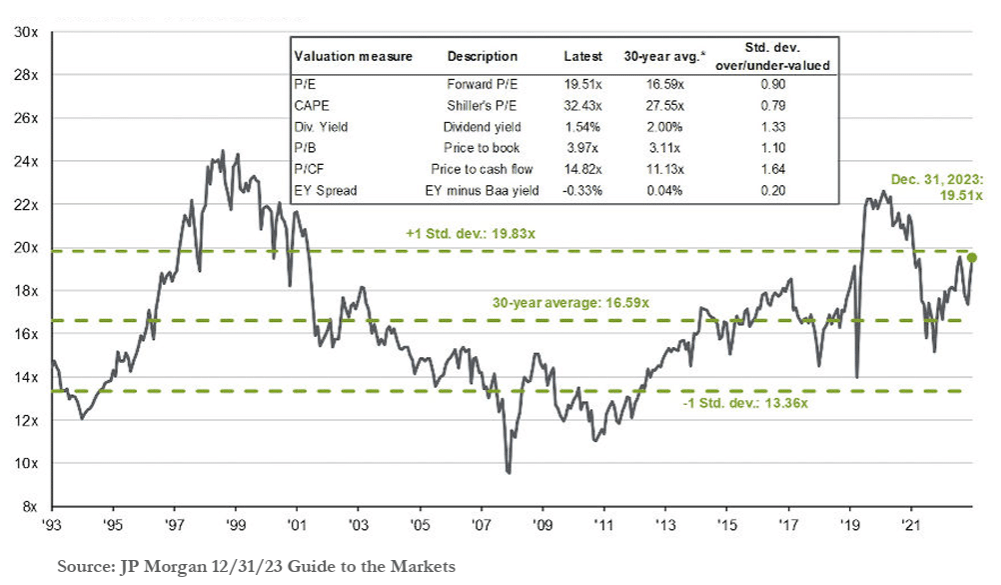

Stocks: Despite a strong year in 2023, the outlook for stock returns in the near term remains uncertain given the slowly deteriorating dynamics of the economy. Headwinds include that U.S. stocks are now expensive in historical terms (see chart below) and that we still have relatively high interest rates and a Federal Reserve resolute in its battle to fight inflation. Sustained high interest rates, particularly in real terms, are likely to weigh on corporate profits.

Some stocks are particularly expensive, notably the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Tesla, and NVIDIA), which on average gained more than 100% last year. The high valuations in the equity markets suggest that the market is counting on a soft landing with falling interest rates and growing profits.

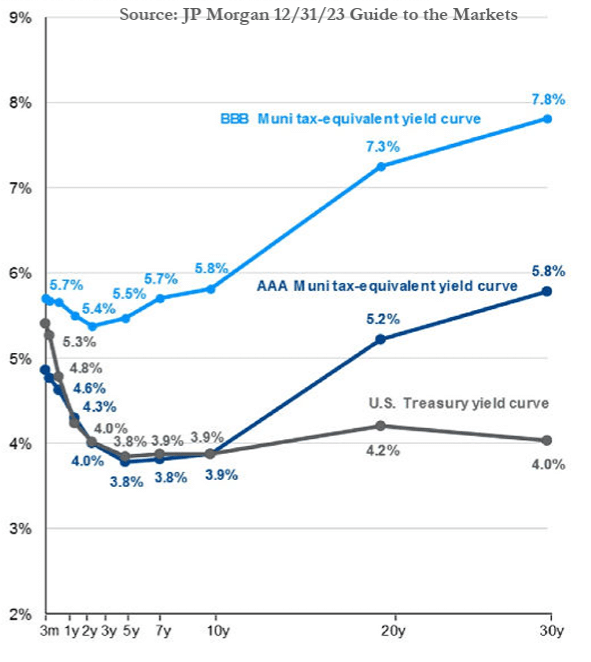

Bonds: The outlook for bonds continues to look pretty bright, mainly due to the likelihood that the Fed is closer to the end of its rate hiking cycle, inflation is coming down, and now bonds offer a respectable coupon rate after years of ultra-low interest rates. Bond coupon rates finally provide real competition for investment dollars versus stocks for more conservative income-oriented investors, especially given the more expensive investment profile of stocks in general. The following chart compares year-end yields for Treasury securities and the pre-tax equivalent yields of municipal bonds (of varying quality) for investors in the top tax bracket. Muni’s have a particularly strong yield advantage in the longer maturity ranges.

Risk Factors: There continue to be downside risks to the capital markets, which should be kept in mind as 2024 unfolds. Those risks include gridlock in a hyper partisan Congress over important issues like the federal budget, immigration, and funding conflicts in Europe and the Middle East. The latter is already impacting trade as ships with cargo are forced to take longer more expensive routes around the southern tip of Africa to avoid blockades and conflicts near the Suez Canal. And we should not forget the races for the Presidency and Congressional seats that are now heating up. Presidential years tend to be positive years for equity returns (though past performance is no guarantee of future results).

Also, the Federal Reserve has historically tended to avoid changing their monetary policy in any meaningful way as elections approach so as not to appear partisan. And finally, if forces that could negatively impact inflation (like the price of oil, or commodities, or increased demand for goods and services) slow the decline of inflation or even reverse it, the Fed likely would not cut rates as much as markets are expecting. Any combination of the above risks could disappoint investors.

The longer-term view of markets suggests that the tailwinds stock and bond investors enjoyed in recent years, including massive fiscal stimulus and declining and ultra-low interest rates, will not resurface soon to smooth over inevitable hard economic times. Securities’ values are more likely to be driven by the organic operational successes of businesses rather than help from the federal government.

Sources: Capital Market Consultants, Bloomberg, Department of Labor, Department of Commerce, Morningstar, CNN, World Bank, International Monetary Fund, JP Morgan, Blackstone, National Association of Realtors.