Economic Outlook

Overview

The U.S. economy has slowed under the combined weight of soaring inflation and climbing interest rates— including the highest mortgage rates since 2008. Notable declines in key sectors such as home building, manufacturing and retail sales may have already pushed the economy into a recession (defined as two consecutive quarters of negative GDP growth), but the first “advance” release of GDP data for the second quarter won’t be available until July 28th.

Despite the Federal Reserve raising interest rates by .50% in May and .75% in June, inflation remains at multi-decade highs. Inflation for the last year is running near 9% overall and 6% excluding food and energy. High inflation has eroded real income, which likely will weigh on consumer spending growth in the coming quarters.

Most major stock market indices have slipped into bear market territory. The dollar has strengthened which will depress growth in American exports. Energy prices remain high as the Ukraine crisis continues. Consumer and business confidence have both declined sharply.

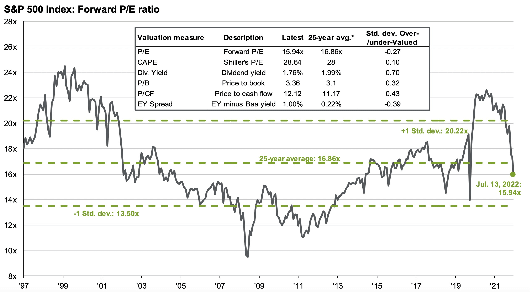

The U.S. economy has displayed an unusual dynamic: one with weakening output but strong employment growth. The unemployment rate held at 3.6% in May, close to the half-century low level. Household and business balance sheets are in decent shape, and the banking system is well-capitalized. Consequently, the economic downturn is not expected to be especially deep or prolonged, but this outlook could change. The S&P 500 index is now trading at more attractive (lower) multiples of projected earnings than we have seen for years, but there remains considerable uncertainty about future earnings.

*Notes. 6/30/22 GDP estimate is July 8th figure from GDPNowfor second quarter. Other 6/30/22 data is from the latest available release, which may be from the prior month. Fed Funds rate is the lower end of target range.

CCM Key Economic Indicators

Indicator

6.30.22*

3.31.22

6.30.21

U.S. Economy

Quarterly GDP Growth

Est. -1.2%

-1.6%

6.7%

Unemployment Rate

3.6%

3.6%

5.9%

U.S. CPI (Core)

5.9%

6.4%

4.5%

Interest Rates

Fed Funds Rate

1.5%

0.25%

0.0%

10-Year Treasury Rate

3.14%

2.13%

1.52%

Currency & Commodities

Crude Oil (WTI)

$111.44

$100.53

$73.52

Gold Price

$1,814

$1,924

$1,757

Trade Weighted Dollar

119.8

116.4

111.6

Confidence

Consumer Confidence Index

98.7

107.6

128.9

ISM Purchasing Managers Index

53.0

57.1

60.9

Stock Prices

Dow Jones Industrial Average

30,775

34,678

34,503

S&P 500 Forward P/E ratio

15.9

19.5

21.5

GDP

After robust growth of 6.9% in the fourth quarter of 2021, the first quarter U.S. GDP contraction of 1.4% (on an annualized basis) caught most observers by surprise. The Ukraine crisis, high inflation, the absence of fiscal stimulus, and the Omicron variant all took their toll and suggest slower growth ahead. A recession, either this year or next, seems likely. It may be similar to the downturn of 1990-1991. That recession lasted for two quarters with a peak-to-trough decline in real GDP of only 1.4%.

Employment

The strength of the labor market is a positive sign for the economy. Jobless claims—a proxy for layoffs and a key barometer of labor market tightness—fell to 229,000 in mid-June, a historically low level. Employers have added an average of 488,000 jobs a month in the first five months of 2022, far above the historical average. We currently have an unbalanced economy in which there are too few job seekers to keep pace with a surge in consumer spending and employer demand for workers. Consequently, employers are clinging to staff and are ramping up wages to attract new workers.

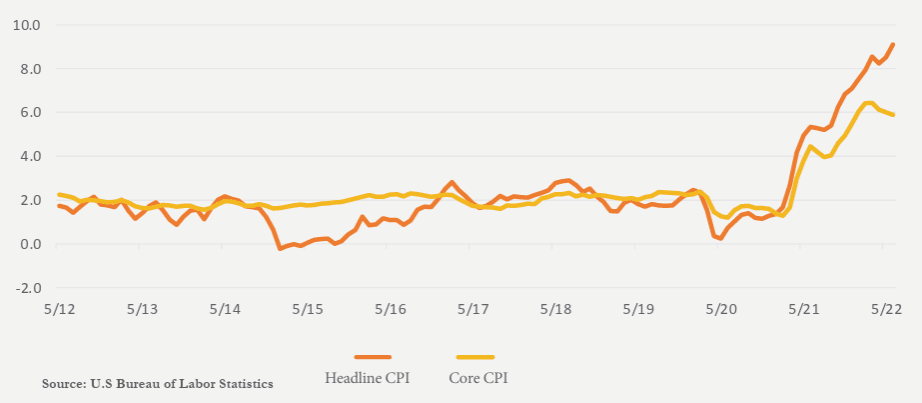

Inflation

After having shown some signs of easing in April, U.S. consumer inflation reversed course and accelerated to its highest level in more than four decades as surging energy and food costs pushed prices higher. Annual headline inflation reached 9.1% in June, while core inflation was 5.9%. However, with housing and potentially energy prices starting to soften, a slowing economy and continued policy action by the Fed, we expect to see inflation levels decline in the months ahead.

Inflation (Consumer Price Index)

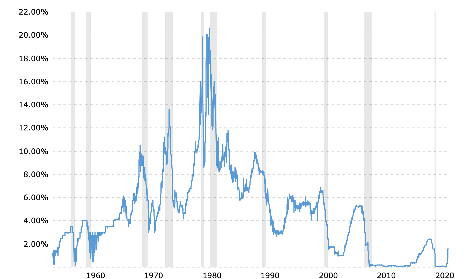

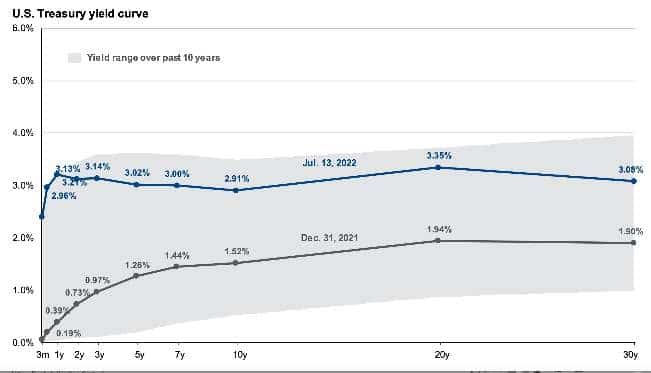

Interest Rates

The Fed faces the challenging task of tightening monetary policy enough to cool the economy and calm inflation while trying to avoid a recession. Evidence that inflation is becoming more entrenched has caused the Federal Open Market Committee (FOMC) to raise its target range for the fed funds rate by 0.5% in May and 0.75% in June. The Fed is expected to raise rates by another .75% in July, with more increases to follow until inflation slows significantly. Rates could top out next year in the 3.5%. to 4.0% range or even higher.

Federal Funds Rate Since 1954

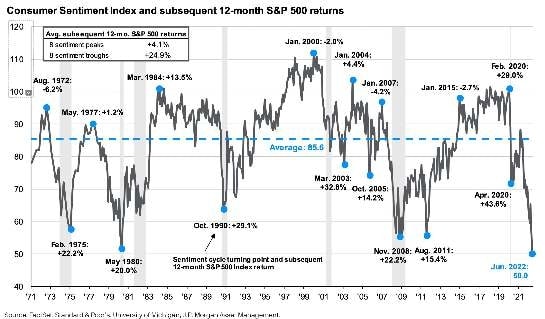

Consumer and Business Confidence

Consumer Sentiment Index and Subsequent 12-month S&P 500 Returns

Various measures of consumer and business confidence have fallen sharply in the last year. The Consumer Confidence Index dropped 23% in the first half of the year, while the Purchasing Managers Index fell 12%, but both remain well above the levels they fell to in the 2008-2009 Great Recession. But other measures such as small business optimism and the University of Michigan Consumer Sentiment Survey are at or near 50-year lows.

This change in sentiment is consistent with expectations of a slowing economy, but perhaps surprisingly may be inversely related with the future returns of the stock market. As shown in the table below, low consumer sentiment readings are typically followed by much higher stock market returns for the next year than are peaks in consumer sentiment.

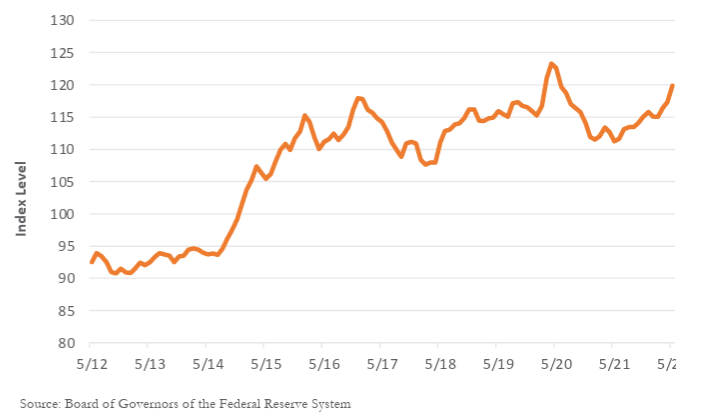

U.S. Dollar

The US dollar rose 7.3% during the first half of the year vs. a basket of other currencies. It rose another 3.7% during the first half of July and reached parity with the Euro, which traded as high as $1.57 in 2008 and $1.22 in early 2021. Although it is now at risk of being significantly overvalued, with the Fed at the forefront of major central bank tightening, the dollar could continue to strengthen. Should rising inflation and interest rates keep markets unsettled, the U.S. dollar could also enjoy safe-haven support.

U.S. Dollar Trade-WeightedIndex

Global Economy

The global economy is facing a series of obstacles this year, ranging from Covid-19 lockdowns, soaring energy and food prices, the Ukraine crisis, and a broadening drive by central banks to combat high inflation by increasing borrowing costs. Growth in China slowed sharply during the first half of the year due to Covid lockdowns, an ongoing issue that may delay an expected rebound. Unlike the U.S., the European economy expanded in the first quarter, but the Russia/Ukraine war and rising inflation concerns may ultimately push Europe into recession. This would put additional downward pressure on the value of the euro. Emerging economies worldwide have felt a financial strain after the Fed’s interest-rate increase with some facing the possibility of a debt crisis as global growth slows and hopes for a reprieve from rising inflation evaporate.

Outlook

There is much to be concerned about. Persistent supply shortages, a 40-year high in inflation, and the Federal Reserve’s aggressive efforts to tame price pressures by raising interest rates are cooling the U.S. economy. Growth is also slowing worldwide. An end to the war in Ukraine is not in sight and neither is the end of COVID.

The Fed is expected to hike rates to 3.5% to 4.0% in the next year. Higher interest rates will weigh on interest ratesensitive spending, including consumer purchases of durable goods. The sharp rise in mortgage rates will likely cause housing starts to tumble and prices to fall. Over the next year, growth in business investment is expected to turn negative and unemployment is expected to rise.

All of these factors contribute to the likelihood of a recession, and it could be longer and deeper than expected. On the other hand, adept management of interest rates by the Fed could still result in a soft-landing, but this is looking increasingly unlikely.

Market Update

Recap: With a slowing global economy, corporate profit growth declines are sure to follow. Recession fears, higher interest rates, and the outlook for slower profit growth have dimmed investor sentiment. Securities prices have fallen sharply.

During the first half of the year, U.S equities gave back some of the outsized gains achieved in the past few years with the S&P 500 declining roughly 20% (16% in the second quarter alone). The Russell 1000 Index declined 16.7% in Q2 while the Russell Mid Cap and Small Cap indices declined 16.9% and 17.2% respectively.

International equities were not immune from quarterly losses as the MSCI Europe fell 14.5%, the MSCI Japan fell 14.6%, and the MSCI Emerging Markets fell 11.5%. Chinese stocks rose 3.4% for the quarter (6.6% in June) as the country ended its COVID lockdowns and business activity began to pick up again.

Stylistically, Value stocks outpaced Growth stocks in a continuation of a trend that began in 2021. The performance differential between these two investment styles was over 8% last quarter for large companies and roughly 4% to 5% for smaller firms.

Bonds, usually the ballast for portfolios, were not immune from price declines as interest rates soared. The full range of credit qualities was hit in Q2 with prices declining the most i.e., spreads widening, in riskier bonds. The Bloomberg Aggregate, a proxy for the broad bond market in the U.S. declined 1.6% in Q2, while government bonds retreated less than 1% and high yield bonds fell almost 10%. Losses also spread to non-traditional asset classes. Indices representing commodities (-6%), global natural resources (-16%), and U.S. real estate investment trusts (17%) were all down substantially.

Outlook

In the near term, the outlook for equities and bonds does not seem particularly bright with profit growth winding down, interest rates on the rise, and plenty of uncertainty to go around the major developed and emerging markets economies. A U.S. recession seems likely.

Equities that are bolstered by strong corporate balance sheets, a surer and more stable profit outlook, and that can pay and even raise their dividends despite a slowing economy would appear to be in the driver’s seat in terms of market leadership. This should continue the Value over Growth style trend that has been apparent for some time.

Stock valuations have come “back down to earth” and are at the most attractive levels we have seen for some time. The strength in the dollar also adds to the allure of purchasing international assets. However, it is not clear if the equity market has bottomed and regained its footing. Further consolidation is possible in the months ahead as rising rates take a bite out of the economy.

While short-term interest rates are sure to rise in the coming quarters, it is not as certain that long-term interest rates will follow suit. Long-term interest rates on the liquid 10-year U.S. Treasury have been hovering around 3% for some time despite the forecast of higher short-term interest rates. This would suggest the bond market believes that inflation will decline rather precipitously as the economy slows in the coming quarters. When short-term rates are higher than long-term rates, a so-called inverted yield curve condition, a recession has often followed soon thereafter. The picture that is emerging is of a slowing economy, disappointing corporate profits, stocks searching for a bottom (but perhaps still not there), and a bond market with rising short-term yields and relatively stable longer-term rates.

U.S. Treasury Yield Curve

Sources: Capital Market Consultants, JP Morgan, Department of Labor, Department of Commerce, Morningstar, Bloomberg, National Federation of Independent Business, Eurostat