Economic Update

Overview

In early June, Congress and President Biden reached a last-minute agreement to suspend the debt ceiling through the end of 2024 and avoid the first government debt default in U.S. history. This narrowly averted crisis came close on the heels of the banking crisis in March, which was largely contained by government (and FDIC) action. Despite creating significant financial concerns at the time, the timely resolution of each of these crises allowed for continued economic growth and stock market appreciation.

GDP Growth

Real GDP grew at a 2% annualized rate in the first quarter and is expected to come in at a similar pace in the second quarter of this year. Recent data releases have revealed a still-strong economy not yet on the brink of recession. The labor market and consumer spending remain strong. While unemployment is creeping upward, at 3.7% it remains near a historical low.

We expect the Fed will continue to raise interest rates. The cumulative effects of higher interest rates, growing unemployment, and tighter lending practices are expected to slow the economy later this year. At this point, we believe it is reasonable to expect a modest recession around year-end, with perhaps a 0.5% to 1% contraction in the economy.

*Notes. The current GDP estimate is the March 31st GDPNow figure from the Atlanta branch of the Fed. Other 03/31/2024 data is from the latest available release, which may be from the prior month. Fed Funds rate is the lower end of target range

CCM Key Economic Indicators

Indicator

6.30.23*

3.31.23

6.30.22

U.S. Economy

Quarterly GDP Growth

Est. 2.1%*

2.0%

-0.6%

Unemployment Rate

3.7%

3.6%

3.6%

U.S. CPI (Core)

4.8%

5.6%

5.9%

Interest Rates

Fed Funds Rate

5.00%

4.75%

1.50%

10-Year Treasury Rate

3.75%

3.66%

3.14%

Currency & Commodities

Crude Oil (WTI)

$69.09

$75.68

$107.76

Gold Price

$1,903

$1,979

$1,813

Trade Weighted Dollar

119.7

120.8

120.0

Confidence

Consumer Confidence Index

109.7

104.0

98.4

ISM Purchasing Managers Index

46.0

46.3

53.1

Stock Prices

Dow Jones Industrial Average

34,122

33,274

30,775

S&P 500 Forward P/E ratio

19.1

17.8

15.9

Labor Market

Weaker economic growth should soon begin to weigh on hiring intentions – putting upward pressure on the unemployment rate. The unemployment rate should rise by more than one percentage point by mid-2024, reaching a peak of 4.6%, before gradually moving back to its long-run average of 4%.

But job growth is not likely to slow much in the short term. As of May, the labor market registered a 14-month streak of better-than-expected payroll gains. While small business hiring plans are trending down, the descent has been gradual, and hiring plans have remained historically elevated. Non-farm payrolls have continued to grow at a solid pace in recent months. Other labor market indicators have been less robust as layoffs have moved sideways in recent months and wage growth appears to be slowing.

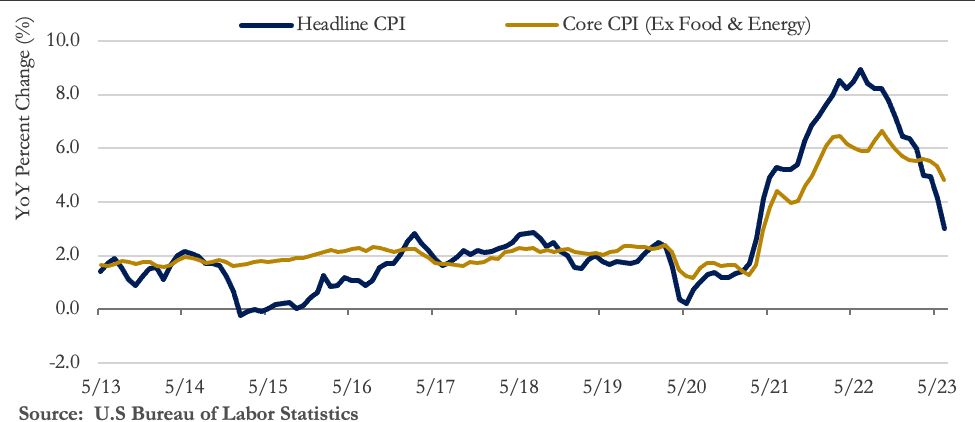

Inflation

Inflation has receded from its multi-decade highs, although the pace of decline has slowed. Annual headline inflation, which reached 8.9% last June, dropped dramatically to 5% in March, 4.1% in May and 3% in June. Core inflation (excluding food and energy) has been stickier, declining only about one percent in the last year to 4.8% in June. These figures show that the Fed has made significant progress in cooling price pressures, but inflation remains above the 2% level Federal Reserve officials are targeting.

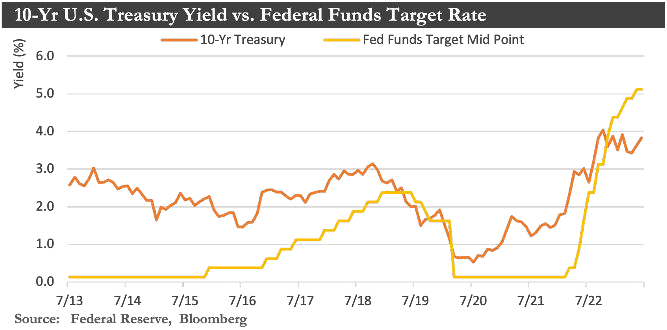

Interest Rates

After ten consecutive increases, the Federal Reserve agreed in June to hold the federal funds rate steady in the 5.0% to 5.25% range. However, it signaled another 0.25% rate increase is likely in July. When these elevated interest rates eventually cool demand-side pressures and inflation moves meaningfully back towards the 2% level, the Fed should be able to cut interest rates back to a level more consistent with its neutral (2.5%) target.

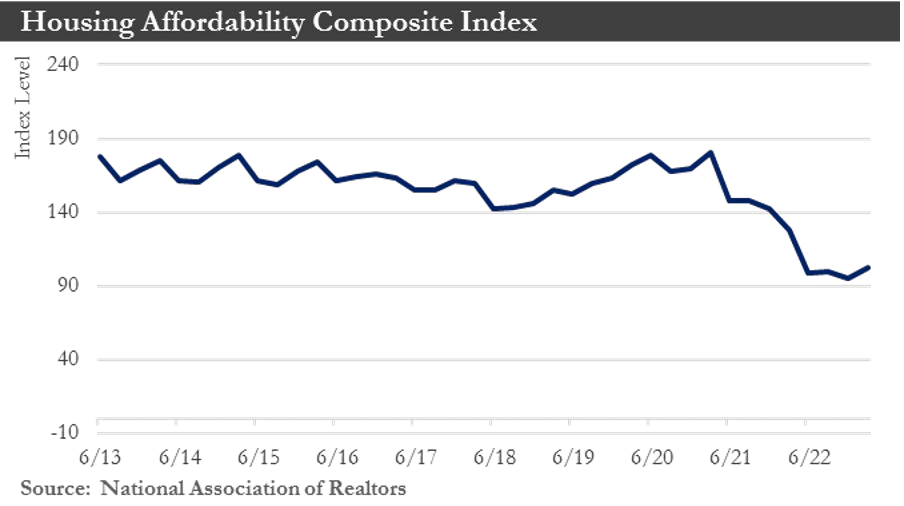

Housing Market

Housing affordability has plummeted in recent years and remains near multi-year lows. Increases in mortgage rates have dramatically reduced affordability, properties listed for sale, and overall sales activity. Supply conditions have been looser in the ‘new’ home segment. As such, this minor corner of the housing market has grabbed a slightly bigger share of overall sales.

Although interest rates are expected to come down over the next couple of years, higher unemployment and tighter lending standards may lower demand for home purchases. As a result, home prices will likely turn lower later this year and could fall by 5-7% from their peak.

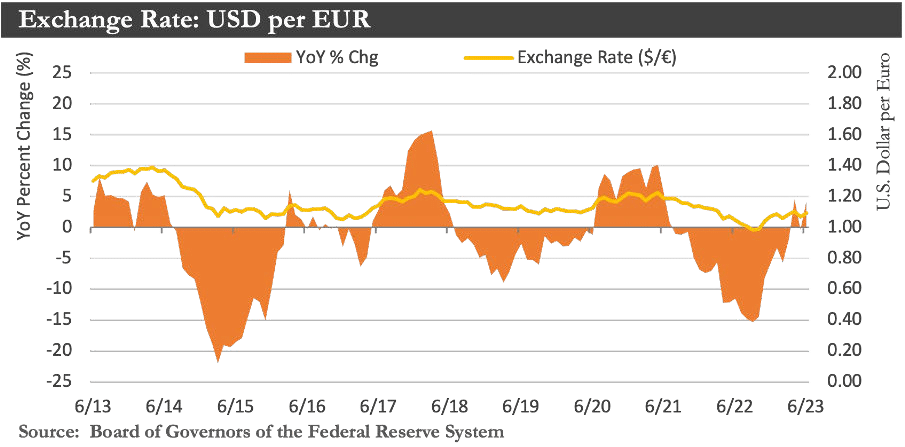

The U.S. Dollar

The dollar has fallen over the past several months and should trade sideways through year-end. While another Fed rate hike or two is likely this year, foreign central banks have largely matched the Fed’s monetary policy path. Higher rates from international central banks should offset a hawkish Fed and keep the dollar relatively stable through the end of the year. However, the Fed is likely to begin easing interest rates before most other central banks. When that happens, the dollar may lose ground relative to other currencies, particularly those of emerging markets.

The Global Economy

In June, the central banks of the world’s three biggest economic blocs came to starkly different conclusions, with the eurozone raising rates, the U.S. on hold, and the Chinese cutting rates. Although GDP growth in Europe has been slightly negative, the European Central Bank remains very concerned about inflation levels. In the US, inflation has significantly moderated (but remains above target levels), while in China inflation has not been a problem. China’s economy has suffered from the aftermath of its extended lockdowns and falling real estate prices.

Market Outlook

Continued stock market appreciation in June contributed to what has already been a successful year for shareholders. The resolution of the debt ceiling standoff and the Federal Reserve holding off on further interest rate increases in June were two macro wins for the market that more than offset concerns about softening corporate profits. Investor frenzy surrounding all things related to artificial intelligence led to the continued appreciation of companies deemed to be beneficiaries of the mainstreaming of this new technology.

During the quarter, the large-cap S&P 500 posted an 8.7% return, the Russell Midcap was up 4.7%, and the small-cap Russell 2000 gained 5.2%. International equities also generally posted positive returns for Q2, but at levels that were significantly lower than U.S. equities. In Q2, the MSCI All Country World Index ex-U.S. was up 2.4%, the MSCI European, Australian, and Far East Index was up 3.0%, and the MSCI Emerging Markets Index was up 0.9%. China was down almost 10% during the quarter.

Growth stocks slightly outpaced value stocks in June, resuming their recent performance dominance, and for the entire quarter, posted a 12.5% return for the Russell 3000 Growth Index vs. just 4.0% for the Russell 3000 Value Index. Most of the growth leadership, and frankly, return for the overall market, has been driven by a handful of mega-cap stocks, including Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, NVDIA, and Tesla. While their profits have grown, investor enthusiasm has driven these stock prices to significantly expanded price earnings (PE) multiples, making them look particularly expensive relative to the rest of the market.

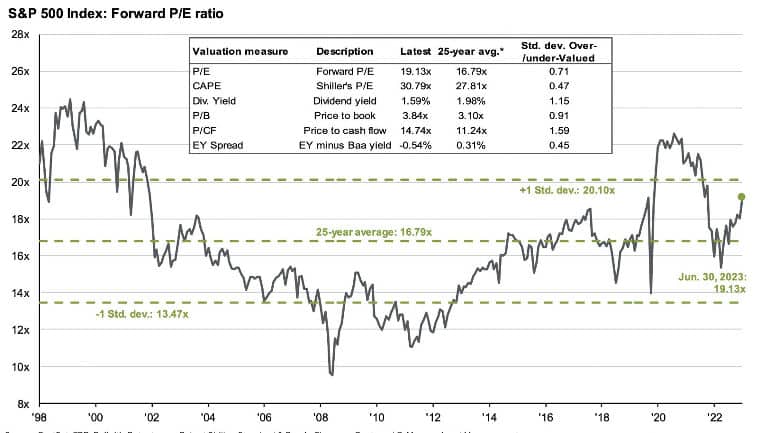

At the end of June, the overall S&P 500 index was trading at 19.1x projected earnings, versus a 25-year historical average of 16.8x. Given our expectation of a slowing economy and slowing earnings growth, this relatively high valuation level is potentially concerning.

Bond investors have their own concerns, mainly that the stickiness of core inflation will result in interest rates staying higher for longer. This resulted in modest losses in the overall bond market last quarter. The Bloomberg U.S. Aggregate Index was down 0.8% for Q2, and global bonds fell 2.2%. High yield bonds, however, performed more like stocks, gaining 1.8% during the quarter.

Looking Ahead

The outlook for stock returns remains uncertain. The potential for continued high interest rates, an economic slowdown, and a resulting contraction in corporate profits are expected to weigh on the market. The U.S. is likely headed into a period of slower economic growth, if not an outright recession. However, the equity market seems to be looking past this well-telegraphed potential recession to a future period of falling interest rates and improving corporate profits.

The outlook for bonds has brightened since last quarter, mainly due to the likelihood that the Fed is closer to the end of its rate hiking cycle. Inflation is coming down, and bonds now offer a respectable coupon rate (after years of ultra-low interest rates).

There continue to be downside risks to the capital markets. Those risks include the Fed possibly overshooting on interest rate increases, a deeper-than-expected recession occurring, more stress in the banking system emerging due to the industry’s deposit level declines, an increase in credit defaults as the economy slows, a possible escalation in the conflict in Ukraine with its potential impact on the prices of oil and commodities, and of course, other unexpected geopolitical events.

A longer-term view of markets suggests that the tailwinds stock and bond investors enjoyed for the past decade, including massive fiscal stimulus and declining and ultra-low interest rates, will not resurface soon. Security values are more likely to be driven by the organic operational successes of businesses rather than help from the federal government, speculators, or leverage. That will likely result in lower market returns than in the recent past.

Sources: Capital Market Consultants, Bloomberg, Department of Labor, Department of Commerce, Morningstar, CNN, World Bank, International Monetary Fund, JP Morgan, Blackstone, National Association of Realtors.