Economic Outlook

Overview

After contracting in both the first and second quarters of this year, the U.S. economy is estimated to have grown at a surprisingly strong annualized rate of 2.9% during the third quarter. The key factors supporting the economy are continued strength in the job market and increased consumer spending. Employers added 1.1 million new jobs in the past three months, wages increased, and retail sales nudged higher. U.S. consumer confidence improved during the quarter, but business confidence continued to fall.

Annual “headline” inflation, which reached 9.1% in June (a 40-year high), dropped to 8.3% in August but remains stubbornly and concerningly high. The Federal Reserve approved its third consecutive interest-rate rise of 0.75 percentage points in September and signaled additional large increases as it seeks to bring inflation closer to its 2% longterm target. The current Fed Funds target rate of 3% to 3.25% is now expected to rise to rise by roughly another 150 basis points (1.5%), with most of that occurring in the next several months.

These rate increases, which have pummeled both the stock and bond markets, are expected to push the economy into a recession in the next year. US stocks and bonds each fell roughly 5% in the third quarter. Year-to-date, the overall U.S. bond market is down about 15%, while the S&P 500 has dropped 24% and international stocks are down 27%.

*Notes. 9/30/22 GDP estimate is October 8th figure from GDPNowfor second quarter. Other 9/30/22 data is from the latest available release, which may be from the prior month. Fed Funds rate is the lower end of target range.

CCM Key Economic Indicators

Indicator

9.30.22*

6.30.22

9.30.21

U.S. Economy

Quarterly GDP Growth

Est. 2.9%

-0.6%

2.7%

Unemployment Rate

3.5%

3.6%

4.7%

U.S. CPI (Core)

6.3%

5.9%

4.0%

Interest Rates

Fed Funds Rate

3.0%

1.5%

0.0%

10-Year Treasury Rate

3.5%

3.1%

1.4%

Currency & Commodities

Crude Oil (WTI)

$79.91

$111.44

$75.22

Gold Price

$1,673

$1,814

$1,731

Trade Weighted Dollar

125.8

120.2

113.5

Confidence

Consumer Confidence Index

108.0

98.4

109.8

ISM Purchasing Managers Index

50.9

53.0

60.5

Stock Prices

Dow Jones Industrial Average

28.726

30,775

33,844

S&P 500 Forward P/E ratio

15.1

15.9

20.3

Labor Market

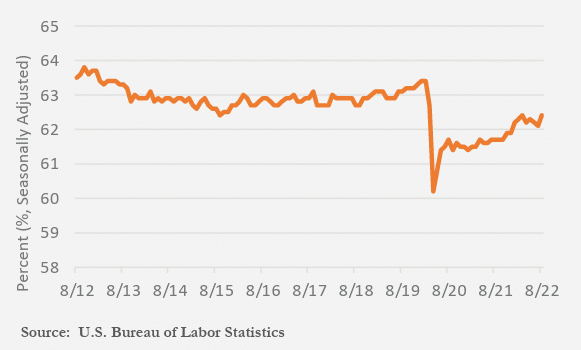

Job growth has been resilient this year, despite a contraction in the overall economy in the first half of 2022 and aggressive interest rate increases by the Federal Reserve. The U.S. economy added 315,000 jobs in August, less than some recent months, but still a substantial number. Total employment now exceeds prepandemic levels, as cumulative job creation since that time has more than replaced the 22 million jobs that were lost. Unemployment actually increased(from 3.5% in July to 3.7% in August) as more people entered the laborsupply, helping to loosen a very tight employment market. The accompanying chart illustrates the recent upward trend in labor force participation rates.

LaborForce Participation Rate

Housing Market

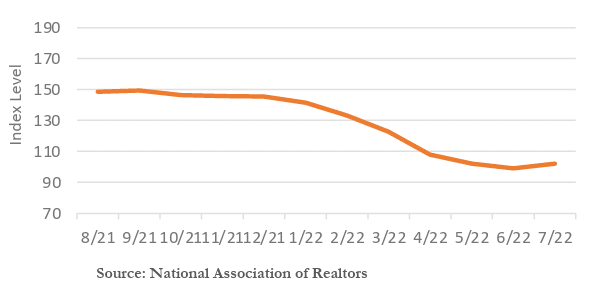

With the average interest rate on a new 30-year mortgage now in the 7% range, there have been sharp negative reverberations across the U.S. housing market. Existing home sales have decreased more than 20% from the start of the year. Prices have also seen some retrenchment and may continue to decline. The sharp deterioration in housing affordability points to an extension of this trend. It may be some time in the second half of next year before rates start to come back down and the market improves.

HousingAffordability Index

Inflation

Inflation pressures have remained strong and stubborn. Overall annual inflation eased to 8.3% in August from 8.5% in July and 9.1% in June. That trend reflects recent declines in prices for items such as gasoline, airfares, and used cars, and slower price increases in other categories, such as groceries. Rents and other shelter costs have emerged as a major driver of overall consumer inflation, keeping it high at a time when many other sources have started to ease.

There remains considerable ground to cover before getting inflation back to a pace that resembles the Fed’s target. Over the past three months, the core CPI has advanced at a 6.5% annualized pace, more than triple the 2% target, and lowering this rate significantly will be challenging. The tight labor market has kept compensation, the largest cost for most businesses, advancing well above 2% annually, while consumer and business inflation expectations remain high.

Inflation (Consumer Price Index)

Interest Rates

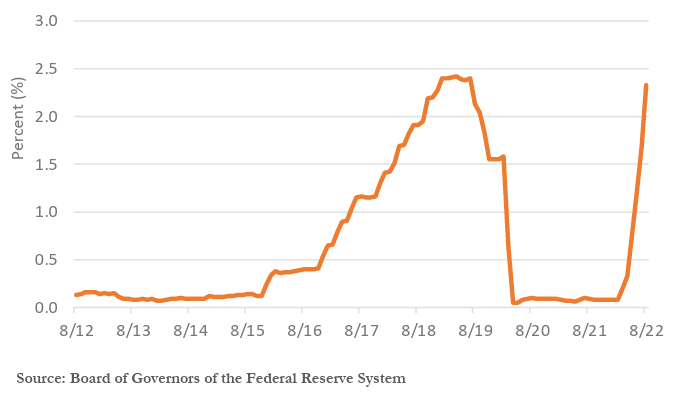

The Fed has raised rates at the most rapid pace since the early 1980s and has also initiated a program to withdraw stimulus by shrinking its $8.8 trillion asset portfolio through attrition.

Even though headline inflation has shown signs of peaking, underlying measures of core inflation have yet to turn decisively enough for the Fed to slow the pace of rate hikes. The Fed has demonstrated a willingness to bring rates into restrictive territory, breaking the current inflation cycle even if it means making a considerable sacrifice to economic growth.

Effective Fed Funds Rate

U.S. Dollar

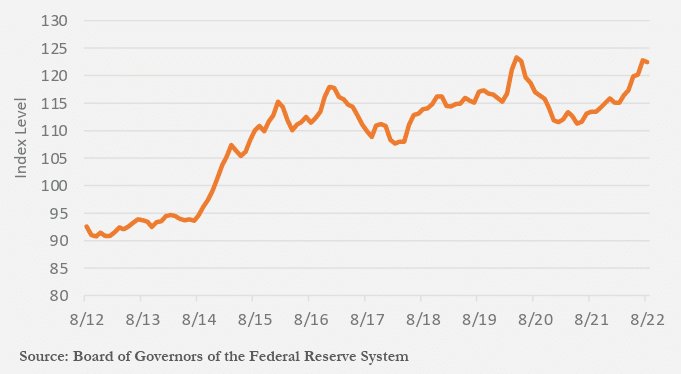

The U.S. dollar has experienced a once-in-ageneration rally. The dollar’s rise this year has been fueled by the Federal Reserve’s aggressive interest-rate increases, which have encouraged global investors to pull money out of other markets to invest in higher yielding U.S. assets. Domestically a strong dollar translates to lower costs for international travel and imported goods and provides a tailwind for containing inflation. For the rest of the world, the picture is grimmer. The surge in the dollar increases the price of imports (such as food and fuel) for other countries, amplifying their rates of inflation and slowing already diminished economic growth. A stronger dollar also makes the debts that emerging-market governments and companies have taken out in U.S. dollars more expensive to pay back, and thus increases default risk on those loans.

Attempts by policymakers in China, Japan, and Europe to defend their currencies have largely failed in the face of the dollar’s unrelenting rise. The Euro recently sank to a 20-year low against the dollar. Continued interest rate increases by the Fed are likely to further exacerbate this trend.

U.S. Dollar Trade-WeightedIndex

Eurozone

Inflation in the eurozone rose to a fresh record in August, underscoring the economic shock dealt by the Ukraine crisis. Driven largely by soaring energy prices, Eurozone consumer prices were 9.1% in higher in August than a year earlier. Core inflation increased from 4% in July to 4.3% in August.

In response, the European Central Bank (ECB) raised its key interest rate to 0.75% from zero—its second hike this year following a 50-basis point rise in July. The ECB has moved aggressively to combat record inflation even as an energy crisis has put Europe on the brink of recession.

Global Economy

Prospects for global economic growth remain dim. The global economy is projected to grow just 2.2% this year. This would be one of the slowest growth rates in decades, well below long-term averages.

Persistently high global inflation and aggressive central bank tightening have been the root causes. However, a sharp slowdown in China has also contributed to this outlook. Continuing Covid related restrictions and an unravelling property market have weighed heavily on the Chinese economy. China is now forecast to grow just 3% this year, far below the 7% to 8% rates we are accustomed to seeing.

Outlook

We expect the U.S. economy will slip into recession in the next year. The Fed’s firmly stated resolve to bring inflation to heel should result in an economic slowdown. Weakness in consumer spending and a squeeze in profit margins will likely result in businesses reducing investment and payrolls. This, together with reduced global demand for US products should lead to a recession.

But this downturn may not be especially deep or prolonged. The underlying fundamentals of the economy, especially the relative strength of balance sheets and the labor market, are reasonably sound at present. Moreover, the Federal Reserve may indeed be able to pull off a “soft landing.” However, the Fed’s hawkish view and the difficulty of actually engineering a soft landing make recession in the next year more likely than not.

Market Commentary

Recap

Many of the major factors that negatively impacted capital markets in the second quarter, continued to play a dominant role in roiling markets in the third quarter. Soaring inflation, rising interest rates, a strong U.S. dollar, declining consumer sentiment, a tight labor market, a pullback in the U.S. housing market, the war in Ukraine, and supply chain issues continued to headline economic news. News out of China, the world’s second-largest economy, suggests their economic growth is slowing rapidly and materially as well. And developments in Europe and the U.K. also signaled economic decline and potentially a recession on the near-term horizon. Analysts’ forecasts for corporate profits in the U.S. continued to decline, as did stock and bond prices.

U.S. equities continued to give back some of the liquiditydriven gains achieved in the past few years when interest rates were near zero. The declines were less extreme in the third quarter than earlier in the year, perhaps due to greater clarity on the end of the Fed hiking cycle, more attractive relative equity valuations (with the S&P 500 price/earnings ratio lower than the past five and ten-year averages at less than 16 times earnings), and the strength of the U.S. dollar.

The S&P 500 was down 4.9% for the quarter and 23.9% for the first nine-months of the year. International equities struggled even more with the MSCI All Country World ex-U.S. down 9.9% in the quarter and 27.1% year-to-date. During the third quarter, emerging markets equities were down 11.6%, Europe was down 10.2%, Japan declined 7.7%, and China was down 22.5%.

Stylistically there was a reversal of fortune as Growth stocks modestly outpaced Value stocks though both retreated in the quarter. While U.S. stocks overwhelmingly turned in negative quarterly performances, small-cap growth stocks posted a surprising 0.24% positive gain for the quarter.

Bond values continued to retreat as interest rates rose in the quarter. The degree of the decline was driven by credit quality and maturity with lower quality holdings (e.g., high yield bonds) and longer-dated maturities taking a larger hit to prices. The aggregate bond index fell 4.75% during the quarter and is 14.6% year to date.

Perspective

Outlook

This year has been particularly difficult one for the financial markets. While the drop in the stock market is not that unusual (bear markets in stocks tend to occur on average about every four years), the drop in bonds has been unusually severe. Key contributing factors include:

• We have experienced a sea change—the end of a 40year period of interest rates and inflation falling from double digit levels to close to zero, and then unexpectedly reversing course in record setting fashion.

• The many years leading up to this time with unusually low interest rates, along with massive government stimulus programs, created excess liquidity which drove up asset prices to unsustainably high levels.

• The pandemic played a role. The surge in demand and supply chain disruptions that followed Covid lockdowns led to shortages that ignited our current inflationary cycle.

•Human error factored in as well. The Fed initially misread the situation as a transitory condition and was slow to respond. It then raised interest rates at the fastest pace in 40 years but has yet to meaningfully contain inflation.

• These issues, together with the war in Ukraine, slowing global growth and exceptional appreciation of the dollar have all combined to create even larger losses in international investments.

Confronted with rising interest rates, declining profits, slowing global growth and more than ample geopolitical uncertainty, the near-term outlook for equities appears gloomy. The positives include still solid business and consumer balance sheets, relatively lean corporate inventories that will need rebuilding when the economy turns up, and trillions in cash waiting to be invested. Additionally, a provision of the recently passed Inflation Reduction Act (IRA) was a 1% “buyback tax” levied on corporate stock buybacks. Companies planning such stock purchases may well choose to move those purchases into 2022 before the new tax goes into effect in 2023. Valuations also appear to be more attractive than we’ve seen in years, which should boost longer-term returns. This is particularly true in the bond market, where yields on many issues have jumped dramatically.

A longer-term view of markets suggests the tailwinds stock and bond investors enjoyed for the past decade including massive fiscal stimulus as well as declining and ultra-low interest rates will not likely come to the rescue of the markets. Securities values are more likely to be driven by the organic operational successes of businesses and not because “there is no alternative” to owning stocks. Market volatility could well remain elevated in comparison to recent years which could also help create new opportunities for investors.

Sources: Capital Market Consultants, Department of Labor Statistics, U.S. Bureau of Economic Analysis, Department of Commerce, Morningstar, Bloomberg, The Conference Board, Eurostat, Peoples Bank of China