Economic Outlook

Overview

This summer’s combination of easing inflation and cooling in the labor market fueled optimism that the U.S. could be on the cusp of achieving a soft landing and avoiding a recession. With this goal in mind, the Fed decided not to raise interest rates at its latest meeting in September.

However, the latest inflation and employment reports have come in stronger than expected, as have recent estimates of GDP growth. As a result, one or more additional rate increases seem likely, and the Fed has indicated that it expects to keep rates higher for longer than previously anticipated.

Toward the end of the quarter, the US government narrowly avoided a shutdown by arriving at a continuing resolution that will expire on November 17th. This bipartisan compromise led to a shakeup in the House leadership, which has yet to be resolved.

Rising interest rates and political uncertainly led to declines in stock, bond, and real estate markets, while energy prices and the dollar appreciated.

Shortly after the quarter ended, the war in Israel began with a large-scale terrorist attack by Hamas. We are deeply saddened by this unfolding tragedy. While the human, physical and emotional toll has already been enormous, the global economic impact is not yet clear.

*Notes. The current GDP estimate is the October 10th GDPNow figure from the Atlanta branch of the Fed. Other 9/30/23 data is from the latest available release, which may be from the prior month. Fed Funds rate is the lower end of target range.

Economic and Capital Market Commentary

Indicator

9.30.23*

6.30.23

9.30.22

U.S. Economy

Quarterly GDP Growth

Est 5.1%*

2.1%

2.6%

Unemployment Rate

3.8%

3.6%

3.5%

U.S. CPI (Core)

4.4%

4.9%

6.6%

Interest Rates

Fed Funds Rate

5.25%

5.00%

3.0%

10-Year Treasury Rate

4.38%

3.75%

3.52%

Currency & Commodities

Crude Oil (WTI)

$90.77

$69.09

$79.91

Gold Price

$1,871

$1,903

$1,672

Trade Weighted Dollar

122.1

119.7

125.5

Confidence

Consumer Confidence Index

103.0

110.1

107.8

ISM Purchasing Managers Index

49.0

46.0

51.0

Stock Prices

Dow Jones Industrial Average

33,507

34,122

28,725

S&P 500 Forward P/E ratio

17.8

19.1

15.1

GDP Growth

Real GDP grew at an annualized rate of 2.1 percent in Q22023, driven mainly by solid growth in consumer and business spending. Strong retail sales growth (a measure of spending at stores, online, and in restaurants) suggests a broad surge in consumer spending, which is the largest component of GDP. Households have lowered savings rates and relied on credit card debt to finance this strong spending growth. Despite solid job and wage growth, delinquencies on mortgages, auto loans, and credit cards have all increased, likely due to higher interest rates.

Available data from July and August suggest that real GDP expanded rapidly in the third quarter. The economy looks to be on track to grow at a strong 4% or 5% annual pace in the third quarter. As a result, the likelihood of a recession in the near term is declining. However, with the Fed expecting to maintain interest rates at a higher level for a longer period, a future recession is still possible, although it would likely be mild.

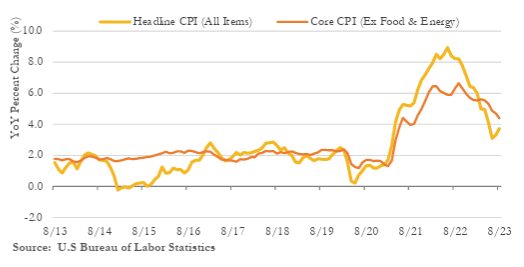

Inflation

Annual overall inflation rose 0.4% to 3.7% in August. Energy prices significantly drove August’s acceleration, rising the fastest since June 2022. The 12-month change in core inflation (which excludes food and energy costs) continued dropping, falling 0.3% to 4.4%. Inflation is expected to continue trending lower. Smoother functioning supply chains and higher financing costs for big-ticket items like vehicles have reversed the rapid growth in goods prices that occurred over the past three years. Inflation in residential rental prices is also expected to slow sharply over the next year as more apartments are completed.

While inflation has remained above the Federal Reserve’s target, enough progress has been made that we are likely close to the peak in the federal funds rate.

Inflation (Consumer Price Index)

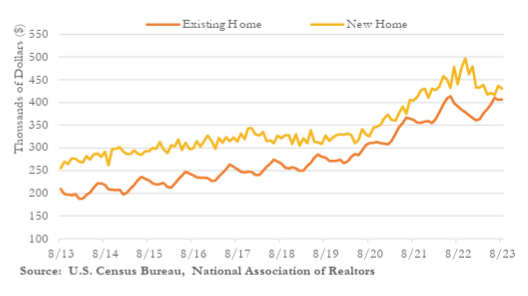

Housing Market

The housing market has remained under pressure with elevated mortgage rates and prices. Home sales activity has remained near multi-decade lows. The elevated rate environment has not just held back would-be buyers; it has also posed a hurdle on the supply side, as existing homeowners with much lower in-place mortgage rates have become reluctant to move.

The tightness in the resale market has kept a floor on existing home prices while also pushing more would-be buyers to the “new” home market, where prices have been falling. Single-family new construction has continued to be propelled by buyers who have become disenchanted with the resale market, where inventory is low, and prices are high.

U.S. Home Median Sales Price

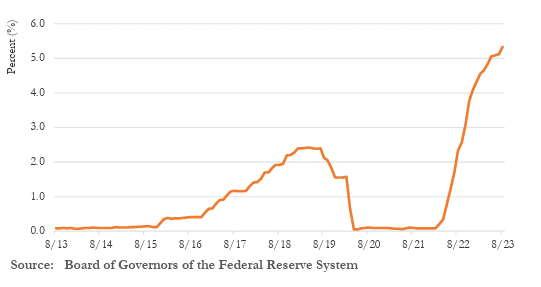

Interest Rates

At the September meeting, the Federal Reserve Open Market Committee (FOMC) maintained the federal funds rate in the 5.25% to 5.50% range.

The Fed has now forecast the closest thing to a perfect landing for the economy: real GDP growth would barely move below its trend pace in 2024, while the unemployment rate would effectively land right on its steady-state level, and inflation would grind back to target. At the same time, Fed members have maintained that one more hike is on the table for 2023 and project the federal funds rate will be lowered to around 5% by the end of 2024, implying two rate cuts next year if the central bank increases them again this year.

The September meeting highlighted the ‘higher for longer’ rhetoric that the Fed has reinforced over recent meetings. This has helped to maintain tight financing conditions.

Effective Fed Funds Rate

Labor Market

Unemployment has risen from a low of 3.5% to the current rate of 3.8%, the highest level in 18 months. Hiring slowed considerably over the summer, with average job creation of 150,000 positions per month in June, July, and August. However, the number jumped in September to 336,000 jobs created, so this slowing trend may be reversing.

The Global Economy

Recent data have signaled deepening troubles for China’s economy. The economic recovery in China has been losing momentum due to decreasing exports, a beleaguered housing market, and record-high youth unemployment. Most importantly, China is on the brink of falling into deflation, a scenario that could drag the economy into a downward spiral. China’s central bank has trimmed interest rates several times this year. China’s central bank should lower interest rates further in the coming months, though such moves alone may not dispel deflationary pressures.

In contrast, the European Central Bank (ECB) delivered a tenth straight rate hike last week, raising its Deposit Rate from 0.25% to 4.00%. The ECB has signaled that the peak in policy interest rates has been reached. Given indications of slower wage growth and a sharp deceleration in economic growth, both wage and price inflation should continue to move in a favorable direction in the months ahead. ECB policymakers will want to see inflation closer to their 2% target before considering rate cuts. The euro could lag due to a likely end to ECB rate hikes and underwhelming Eurozone economic performance.

U.S. Dollar

The dollar’s prospects for the coming quarters have improved. With a deteriorating global macroeconomic backdrop, particularly in China (see below), the dollar could see a boost through the end of this year. The resilience of the U.S. economy and the possibility of additional Fed rate hikes should also attract investors toward dollar-denominated assets and support the dollar through the end of 2023.

Longer term, the dollar should weaken. The prospects of Fed rate cuts in 2024 would weigh on the dollar. However, with the Fed likely to deliver a version of a “higher for longer” stance on interest rates, the dollar could remain resilient throughout 2024.

Market Outlook

U.S. Equities. With a few exceptions, September and the third quarter saw the global equity markets give back some gains earned in the first half of 2023. U.S. stocks across the capitalization and style spectrum delivered modest declines in the third quarter. Small-cap and midcap stocks lost more ground than larger company stocks. The S&P 500 was down 3.3%, the Russell Mid Cap Index was down 4.8%, and the index of smaller companies, the Russell 2000, was down 5.1%.

There was a modest reversal of fortunes when comparing Value and Growth style stocks. Unlike earlier in the year, Value stocks lost less ground than Growth stocks in the third quarter. The result was a pullback from some of the extreme valuations seen in Growth stocks earlier in the year driven by investor enthusiasm over all things artificial intelligence.

Outlook. Although valuation levels have improved, the outlook for stock returns remains uncertain. This is largely due to higher interest rates which are likely to stay this way for longer than expected, a probable slowing in the economy, and the negative impact this should have on consumer and business demand.

Downstream, this should continue to impact corporate profits, which have grown more slowly in the past year. Despite a remarkable third quarter, the U.S. is likely headed into a period of slower economic growth. The equity markets earlier in the year seem to have been looking past this well-telegraphed slowdown to a period of falling interest rates. But some stock prices, especially those driven by more speculative impulses, may have to adjust to the realities of a less constructive longer-term economic outlook.

High interest rates and a slowing economy also represent headwinds for the real estate industry. After falling 26% last year, the S&P real estate sector stock index is down an additional 8.9% through the first three quarters of this year (although the private real estate funds we use have fared much better).

Global Equities. International equities also lost ground in the third quarter. The MSCI All Country World Index exU.S. was down 3.8%. There were a couple of notable exceptions, with Indian stocks up 2.7% for the quarter and companies in so-called Frontier Markets up about 2.0%.

Bonds. Bond markets, too, underperformed for the quarter, except for short-term fixed-income instruments. Markets responded to the rise in the yield curve and the Fed, signaling they will hold interest rates higher for longer. Longer bond maturities were especially hard hit as rates on government bonds with maturities of 10 or more years climbed to about 4.7%.

Bond prices globally also took a hit from rising interest rates and the prospects of rates being held higher for longer by central banks. The broad Bloomberg Aggregate Bond Index was down 3.2%.

The longer-term outlook for bonds continues to look positive, mainly due to the likelihood that the Fed is closer to the end of its rate hiking cycle, inflation is coming down, and now bonds offer a respectable coupon rate not seen for many years.

There continue to be downside risks to the capital markets, which should be kept in mind as 2023 ends. These risks include another Congressional budget impasse in November, the Fed overshooting their rate increases, a recession, more banking system stress (due to decreased deposits and rising default rates), a possible escalation of the conflict in Ukraine, and, of course, other unexpected geopolitical events (such as the war in Israel that began in early October).

A longer-term view of markets suggests that the tailwinds stock and bond investors enjoyed in recent years, including massive fiscal stimulus and ultra-low interest rates, will not likely be seen going forward. Securities’ values are more likely to be driven by the organic operational successes of businesses rather than help from the federal government.

Sources: Capital Market Consultants, Bloomberg, Department of Labor, Department of Commerce, Morningstar, CNN, World Bank, International Monetary Fund, JP Morgan, Blackstone, National Association of Realtors.