Key Takeaways:

-

Remote work takes planning – Choosing the right location, rental, and setup makes working abroad smooth and enjoyable.

-

Balance is key – Set clear work hours and protect time to unplug and enjoy the experience.

-

Be flexible – Things won’t always go as planned, but rolling with the changes is part of the adventure.

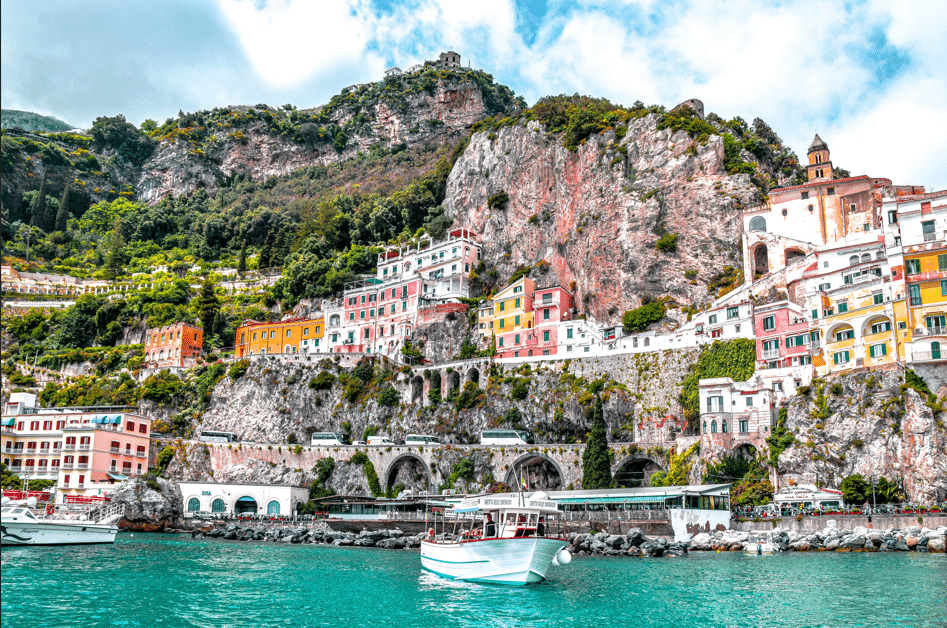

In my previous post, I wrote about my wife and I finding work-life balance while we are away for extended periods of international travel. This has been a fun and evolving journey for us to share. We found our happy place on the coast of the Mediterranean Sea and now try to spend a month there twice a year. Below are some of the details of how we make remote work – work.🙂

We both feel very lucky that we have careers that allow us to work virtually. With our laptops and mobile phones, we don’t miss a beat. And as devastating as Covid was, it did show many of us that much of our work can be done remotely.

It’s easier for me as I am a wealth manager, and client meetings over Zoom are effective (whether in Boulder or Cassis), and most of the work I do can be accomplished on my own time.

For my wife, who is an interior designer, it’s a bit more challenging as she needs to plan out in-person site visits at various stages of renovation. FaceTime and Zoom have been extremely helpful to her as she virtually visits with homeowners and contractors on-site.

Table of Contents

Picking Your Spot

Deciding where to go on an extended stay is fun to think about and plan. My wife and I often scour maps, read travel books, and look at websites as we talk about our next excursion. We spend countless evenings enjoying this as we unwind after a busy day.

Are you into bustling city life with lots to do and see, or do you prefer quiet spots like small towns where there is less opportunity for these experiences but more solitude.? Do you like the sea or mountains, or both? These are important considerations as you plan for your trip.

Staying put for a whole month saves money and lets you really get to know the area. You unpack once, figure out where everything is, and settle into local life. We find it much less stressful than moving around. An added bonus is reducing travel times on planes, trains and in the car as you spend less time traveling from one place to the next.

Making a Budget

Think about how much you can and want to spend. You’ll need to cover where you’re staying, eating (at home or out), getting around, and doing all the fun stuff. It can get quite expensive to spend a month abroad, and things really add up.

Also, how many people are coming along? Are friends dropping by? That all affects how much space you need and how much you’ll spend on a place.

Finding the Right Place to Stay

We love searching on Airbnb and Booking.com to find that perfect spot. The right place has to check all our boxes for location, aesthetics, needs, and comfort.

We like to get a place with a view of the sea and close enough to walk to town. Living in Colorado, we are landlocked, and although we love the mountains, when we travel abroad, we often find ourselves drawn to the water as we find the sea soothes our souls. Another non-negotiable consideration for us is having an outstanding outdoor space with shade so we can work and eat outside.

Comfort is also a huge priority for us. We only go for places that people rave about, especially when it comes to an inviting bed, lack of noise, fast internet, and easy parking. Photos and reviews work great for this. There’s no reason to ever rent a place without several positive reviews. You don’t want a big surprise when you land at your rental. Normally, if the reviews are below 4.7, we swipe and move on. It’s kind of arbitrary, but that’s our process, and it has worked well for us.

Setting Up a Good Place to Work

Good lighting is important. You need a place that gets enough sunlight and has decent lamps for working or reading at night. Why work from a cave when you can get a place that’s bathed in sunlight?

Your desk and chair should be comfortable since you may be sitting there a lot. We actually check out the furniture in the listing’s photos to make sure it looks good.

Lots of places boast dedicated workspaces, however, often, a big dining room table is all you need and is sometimes the best place to work from. If you’re traveling with a partner, you really need two spots to work from that are quiet and private enough. My wife enlarges the photos on the rental websites and always finds things I just don’t see. As an interior designer, she has the perfect eyes for this. We want cozy areas both inside and outside, and a highly functional space.

Staying Connected

You’ve got to have fast and reliable Wi-Fi. We always check this out and bring a portable mobile Wi-Fi hotspot that we can both use simultaneously while we are out and about and as backup at our place.

An offering like Solis has worked well for us. It’s also much less costly than both of us purchasing global monthly cellular phone plans from our carrier. We bought a device (hockey puck size) for a few hundred dollars and then can buy data plans that we can always top up as needed. It’s not a perfect solution, but it works well most of the time. You can also add an e-sim card to newer phones, but this has been challenging for us to do effectively.

For business calls, we mostly use Zoom on our laptops and phones. And remember to bring the right plugs and chargers for all your gear.

What to Pack

We always end up bringing more than we need. One day, we may figure it out, but it’s hard because the weather can be variable, and we also need to pack clothes and gear for hiking, swimming, and going out for a nice dinner. We’ve each settled on a big suitcase and not-so-small backpack that we can carry on the plane. We use our backpacks for our daily excursions once we have settled in.

Getting There and Around

Since we live in Colorado and we mostly visit France and Italy, we usually fly on Delta or Air France, which have hubs in Denver. Both airlines have direct flights to Paris, which means less layover issues. Getting stuck in Paris sure beats getting stuck in Atlanta – sorry Atlanta 🙂. Once in Paris, if we have a flight issue, we can easily connect to anywhere in Europe via plane or bus. We like to leave in the early evenings from Denver, have dinner and a drink, watch a movie, and try to sleep. Then we wake up early in the morning in Paris. It’s hard to beat.

When renting a car, we’re careful to understand what we’re agreeing to. It’s cheaper to book these in advance but make sure to read the fine print. We never pay for the supplemental auto insurance because our credit cards cover the costs if there is any damage. And trust me, we have utilized this protection at least a few times for small scratches, which seem inevitable when driving narrow roads that were built hundreds of years ago and designed for feet or hooves versus wheels. It seems like car rental companies build “damage” into their profit margin as we have been dinged for the tiniest of bumper scratches which is super annoying but part of the game.

Money Stuff

Bring at least two credit cards and a debit card that doesn’t charge you extra to use ATMs (we get reimbursed for these fees). We use Schwab for this. In Europe, you can pay for almost everything with your phone, with Apple Pay, Google Pay, or your linked credit card. And make sure you keep the second of the credit cards in a safe place and as a backup. We had a bag stolen in our car while hiking, and we learned the hard way. Thankfully, we were up and running quickly as our credit card company, Chase, reissued a new number immediately that we could use on our phones, and we didn’t need to wait for replacement cards like the old days. We love that you can pay almost anywhere by phone. Europe is far ahead of us in this regard.

Health and Safety

Some health insurance policies from back home might cover you abroad, so check out their policies before you leave. Our Chase credit card will actually pay some of the costs if we need to be flown home because of an emergency. We never want to test out that service. If you do have health issues, you should research the hospital situation near where you will be staying.

Work Hours

We usually work from 7 to 11 in the morning. That’s when we focus on our solo work, like working on projects and responding to emails, which is so much of what we normally do. Then we take a break to enjoy the day; go for a hike, or a swim, or both, and check out the area. We always have a tasty lunch, whether we make it or go out. After that, it’s heading back for our second round of work from 4 to 8. Dinners are usually enjoyed at home on the deck with a view of the sea.

Time Off

One thing that is important is to “unplug,” as this assures that part of your trip is actually a vacation and that you get refreshed. So we typically pick a week, including the weekends on both sides, and have 10 days where we really try to check out. If you plan your trip around a national holiday, you can even leverage more time for the vacation part of your getaway.

Final Thoughts

Getting remote work right means planning ahead and being ready to adapt. You’ve got to think about where you’ll stay, how you’ll manage everyday life, and how to balance work with enjoying your travels. And while traveling, things always happen that are unexpected, so be prepared to deviate from your plan. Sometimes, these changes provide new challenges and opportunities, and learning to roll with them is all part of the journey.

I’d love to hear your thoughts and would be happy to answer any questions you have.

As a serial entrepreneur and world traveler, Lee Strongwater, president of Colorado Capital Management, brings a global perspective to investments and life planning.

Editor’s Note: This blog post is for informational purposes only and does not constitute financial, legal, or tax advice. Readers are encouraged to consult with a qualified professional regarding their individual circumstances. Please refer to our firm’s website for full disclosures and important information: CCM Website Disclaimer