Key Takeaways:

-

ESG investing can align your money with your values.

-

ESG fund quality and impact vary widely.

-

Look deeper than ratings—focus on purpose, holdings, and action.

Once the province of a relatively small number of socially responsible investors, integrating environmental, social and governance (ESG) metrics into financial decision making has become big business.

The Global Sustainable Investment Association reports that more than $35 trillion worldwide has been invested in ESG strategies, about a third of total global assets under management. This has taken place in less than two decades.

The explosive growth in the use of ESG metrics is occurring in private markets as well. As of October 2021, ESG screened assets accounted for roughly 36% of total global private market assets and nearly half (49%) of private debt, according to investment research firm Preqin.

The ESG Conundrum: The Pros and Cons of ESG Investing

There are currently over 1,250 ESG exchange traded funds worldwide, a number which has grown rapidly as fund companies recognize how popular the concept of sustainable investing has become.

With the growing number of ESG offerings has come an increasing number of concerns about the industry from a variety of sources including academicians, politicians, journalists and business leaders. When Tesla was recently dropped from the S&P 500 ESG Index, Elon Musk called ESG a scam.

In this article we describe both the pros and cons (the conundrum) of ESG investing. We review the most credible of the many concerns and suggest a framework for addressing these issues.

Solving the conundrum requires cutting through the industry hype to understand how fund managers construct their ESG portfolios and to what extent they pursue meaningful impact.

The Benefits of ESG Investing

Align your Finances with your Values

The main benefit to ESG investing is that it allows people to align their finances with their values.

A growing number of high-net-worth individuals and families want to earn a financial return, but not by investing in companies that contribute to environmental damage, social or economic inequities or the proliferation of harmful products and business practices.

An ESG strategy focuses investments on companies that do less harm—and in some cases may actually make the world a better place.

Little to no Impact on Portfolio Returns

Early on most investors assumed that incorporating non-financial factors like ESG into investment decisions would dampen performance, but that is not necessarily the case.

One macro analysis of over 2000 studies found that 63% showed a positive correlation between ESG orientation and performance and only 8% showed a negative relationship.

Reduce Portfolio Risk

Intuitively, it also makes sense that an ESG approach could reduce portfolio risk, since strong environmental, social and governance policies can lessen companies’ exposure to accidents, fraud, lawsuits, boycotts and other adverse events.

This relationships appears to be supported by the data. One study found that top-rated ESG companies had, on average, nearly 29% lower volatility than comparable companies within their industries.

Shareholder Activism

ESG fund managers may also engage in shareholder activism, exerting pressure on companies to do better, whether that means reducing emissions or promoting workplace diversity or reducing income inequality through executive pay resolutions.

Shareholder activism, which can include everything from informal discussions to initiating and leading proxy votes can be a powerful tool for improving corporate behavior.

Drive Company Innovation and Growth

And finally, ESG investing can drive innovation and growth as companies look for ways to manage environmental, social and governance risks more effectively.

Companies with higher scores can normally be expected to have a lower cost of capital, which can produce greater returns on investment, higher profits and higher share prices.

We recommend Larry Swedroe and Sam Adam’s new book on Sustainable Investing which talks about these considerations at length.

The Primary Concerns About ESG Investing

While there are wide-ranging critiques of ESG investing, we believe the most credible concerns include the following:

Performance

We have reviewed a large number of studies relating to the performance of sustainable investing, and the results are mixed. Our key takeaways are that: 1) integrating ESG (non-financial) data into stock selection can be expected to lower risk, 2) exclusionary screens and higher fund expenses lower expected returns, and 3) impact driven investors may elect to give up some return potential in exchange for meaningful impact.

The recent surge in demand for highly rated ESG investments has pushed up their price, providing a boost to performance, but this can only go on for so long. Higher pricing ultimately represents a headwind that should dampen future returns. On the other hand, more sustainable firms should be more attractive to customers and employees and may thus be better positioned to outperform over the long-run.

Relevance

ESG metrics were originally designed to measure investment risk (the risk to a firm’s share price) and may have little to say about the broader impact on people and planet. As a result, ESG ratings may not align well with the goals of a values driven investor.

Consistency

ESG ratings are not consistent. One study from MIT of the six major ESG rating firms found that their ratings had a correlation of only 61%, indicating widespread variation in how different teams evaluated ESG.

Compare this to a 99% correlation among credit ratings from the two main credit rating agencies, Moody’s and Standard & Poor’s.

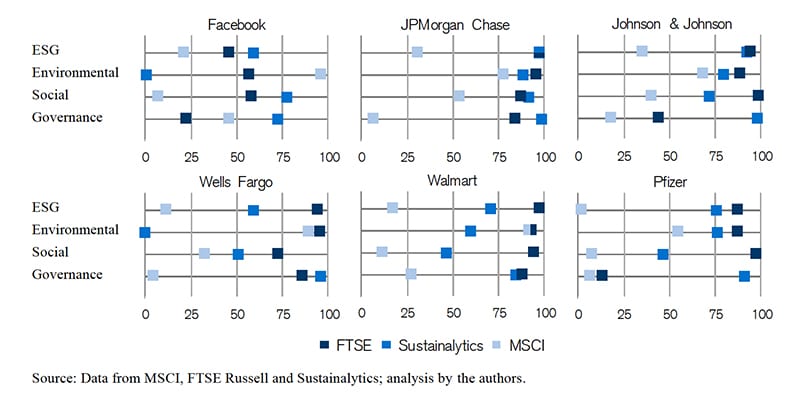

Below, you can see a table comparing ESG ratings from three major providers (MSCI, Sustainalytics and FTSE-Russell) for six well-known American companies.

Facebook earned a top environmental rating from MSCI but near zero from Sustainalytics. Wells Fargo got great governance ratings from Sustainalytics and FTSE but did poorly in the same category according to MSCI.

The ratings are so inconsistent that they may be of very limited value to the average sustainability-focused investor.

These large variations can be largely attributed to differences in:

1) What is being measured (such as environmental fines vs. pollution emitted)

2) The source of the data (company self-reporting vs. analyst models or third party sources)

3) Weighting schemes (such as emphasis on environment vs social or governance scores)

4) How missing data points are handled (ignored, assigned the lowest score, assigned an average score, or estimated).

Rigor

The rigor of ESG screening varies widely (from ESG “aware” to “select” to “leaders”).

The less rigorously screened funds may look a whole lot like an unscreened index, but with higher management fees.

An analysis by Bloomberg found that the portfolio of iShares ESG Aware MSCI USA (ticker ESGU), one of the largest ESG funds, had nearly identical holdings as the unmanaged S&P 500 Index, and that others including the Vanguard ESG U.S. Stock ETF and the iShares MSCI USA ESG Select Social Index ETF also look a great deal like the index.

The “best in class” problem

While some ESG fund exclude whole industries—most commonly fossil fuels—others build portfolios that emphasize the best ESG performers in every industry.

As a result, they may have substantial holdings in oil and gas, fast food, even tobacco. As of 8/30/22, ESGU had 15 energy holdings (including Chevron and Exxon) representing about 6% of its portfolio.

“Best of class” portfolio construction is not a tool that identifies companies providing solutions to global problems or that necessarily eliminates the ones that are exacerbating those problems. It can result in a major ESG index that includes Exxon but not Tesla.

Varying levels of shareholder activism

While shareholder activism can be a powerful tool as described previously, some large ESG fund operators, such as Vanguard rarely, if ever, participate in shareholder activism.

Others like Calvert are leaders in encouraging companies to improve their ESG related policies and practices.

And some, such as Blackrock, are backpedaling and cutting back on their support of shareholder resolutions, possibly because of pushback against ESG investing from conservative political leaders of oil and coal mining states like Texas and West Virginia.

Gaming the system

Scoring systems have flaws.

For example, one study found that while companies in certain ESG funds had, on average, much better reporting of carbon emissions than those in non-ESG funds offered by the same firm, they didn’t actually have lower carbon emissions.

This is the result of an ESG scoring system that places a premium on emissions disclosure, rather than on the emissions themselves.

Some funds virtually eliminate entire industries from their holdings, such as energy and utilities (8% of the S&P 500), which can distort comparisons with competitors.

Expenses

Excessive fees can erode performance in ESG funds just as they do in conventional investments, but investors should potentially be wary of the lowest-cost vehicles.

High quality ESG funds are typically more expensive than traditional investments due to the additional costs of ESG research, rigorous screening and shareholder activism.

Our Four-pronged Approach to ESG Investing

We’ve outlined the primary critiques of ESG funds. These issues demonstrate how difficult it can be for nonprofessional investors to select effective impact strategies.

Our approach provides an alternative way to look at the ESG universe by focusing on these four components:

1. Company purpose or mission

Is the organization a values-driven business seeking to make a positive impact? Is it a Certified B Corporation or Public Benefit Corporation with a multiple bottom line (people, planet, profit) business model? Is this commitment reflected in marketing materials and the prospectus for each fund? Is the firm involved in field building activities such as professional education and advocacy for sustainable investing?

It is not easy to make a difference in the world. It is even harder for firms without a clear vision and without broad leadership commitment to making this happen.

2. Use of funds

We review a fund’s investment and portfolio construction process to understand what is being included and excluded from the portfolio.

Are the negative screens sufficiently rigorous? Does the strategy include an emphasis on including companies offering potential solutions to some of the world’s most difficult problems?

These are the questions that must be answered to determine if a fund is truly aligned with an investor’s values.

3. ESG scores

We look at scores that measure the risks, not to a company, but from a company.

We don’t rely on summary scores from the major ratings agencies.

We focus instead on resources that assess risks to people and planet. And we prefer those resources to use independently gathered raw data from reliable third-party sources as opposed to self-reported company information.

4. Shareholder Activism

We seek to understand what a fund manager is doing to bring about positive change.

This includes reviewing the fund’s history for advancing proxy initiatives, its voting record, thought leadership, and collaboration with others doing this work.

This is how ESG fund managers can make their most meaningful impact.

Please see our article on How to Pick a Great ESG Fund for more detail (including examples) of our approach.

ESG investors have many options, with thousands of managers providing vehicles across asset classes in public and private markets.

But not all ESG strategies deliver equally.

We hope that the approach that we have outlined can help you select the ESG funds and managers that best fit your needs and goals.

Please contact us if we can be of assistance in helping you solve the ESG Conundrum, or visit our Impact Investing page to learn more about what we do.

Steve Ellis has spent his career making an impact, so it’s not surprising that Colorado Capital Management’s founder launched the firm’s entry into impact investing.

- Steve Ellis

- Steve Ellis

- Steve Ellis

- Steve Ellis

Editor’s Note: This blog post is for informational purposes only and does not constitute financial, legal, or tax advice. Readers are encouraged to consult with a qualified professional regarding their individual circumstances. Please refer to our firm’s website for full disclosures and important information: CCM Website Disclaimer